Carriers & Fleets

Navigate freight with confidence

Be better informed, better positioned, and better prepared to anticipate the market cycles with forward-looking insights from ACT Research, your transportation intelligence partner.

Get Transportation IntelligenceThe road to confidence starts here

Predictive Insights: The ability to forecast future market conditions provides carriers with a competitive edge, enabling proactive rather than reactive strategies.

Strategic Planning: Deep dives into specific market segments and comprehensive analyses of trends allow carriers to refine their strategic planning and align it with market realities.

Risk Mitigation: Understanding potential market disruptions and economic indicators helps carriers mitigate risks associated with volatile freight rates and capacity constraints.

Operational Efficiency: Insights into the supply-demand balance, rate trends, and sector-specific dynamics enable carriers to optimize operations for cost efficiency and service quality.

Want confidence in a forecast?

ACT Research’s 2024 forecasts for the Cass Truckload Linehaul Index® were 98.8% accurate on average over the past 18 months, and were spot on from 13 months out.

Actionable supply and demand tools for your business

Carriers need to anticipate market shifts, manage capacity, and strategize pricing. As a transportation intelligence partner, ACT guides carriers through the cycle and provides insights on capacity and rate changes.

Looking to anticipate market shifts, manage capacity, and strategize pricing to make informed decisions about fleet management, route planning, and service offerings based on current trends and future projections in their specific sectors.

From the Cass Transportation Index report to DAT rate data, plenty of market information helps you understand the current market's health. But these insights tell you what has happened, not what will likely happen. You have lots of options when looking for information to help you make important decisions for your business.

With ACT Research, you have a transportation intelligence partner that helps you anticipate and respond to market dynamics effectively with:

- Historically accurate US Class 8 tractor forecasts, trusted for more than 35 years so that you can have clarity on active Class 8 tractor capacity.

- Benefits from ACT’s exclusive partnership with DAT Freight & Analytics to get more detail on contract and spot rates, volumes, loads, and equipment postings so you can have more detail on market trends.

- Benefits from ACT’s exclusive partnership with Cass Information Systems to get more detail on freight volumes and modes (TL & LTL & Intermodal) so you can have more detail on market trends.

- A straightforward, freight-weighted GDP Composite Index to understand consumer demand so you can determine how many new trucks need to be added to the population and clearly anticipate the economic impact on freight.

- A team of industry thought-leaders with more than 250 years of combined experience can help you leverage ACT’s historical knowledge, learning from the past to anticipate the future.

We Focus on 3 Things

Our freight forecasting solutions give you actionable supply and demand insights to make better, smarter decisions for your business, not as a vendor or tool, but as a partner in your process.

- ACT Proprietary Data

- ACT Methodology

- ACT Human Intelligence

ACT Proprietary Data

It starts with an exclusive view of Class 8 trucks and tractor splits, providing clarity on the Class 8 tractor capacity. ACT Research is the only company receiving this information monthly directly from the North American truck OEMs (Daimler, PACCAR, Volvo, Navistar). Separating Class 8 straight trucks and Class 8 tractors gives us (and you) visibility into two important pieces of the supply of Class 8 equipment for the freight markets:

1) The number of new Class 8 Tractors Retail Sales, which means new tractors entering the fleet.

2) The change in the active population of the Class 8 Tractor, measuring the total working fleet.

ACT Methodology

ACT has been providing historically accurate Class 8 tractor forecasts, trusted for more than 35 years by Fortune 500 companies, Wall Street's largest investment firms, commercial vehicle equipment manufacturers and suppliers, rental and leasing firms, and others. Serving the commercial vehicle equipment market for decards, we bring this Class 8 tractor understanding to you, giving a supply and demand-focused, balanced, strong, and flexible foundation of analysis.

ACT Human Intelligence

Our team isn't just experienced; they're seen as the leaders in forecasting demand for commercial vehicles. We bring you insights from the only transportation intelligence company with more than 250 years of combined experience in forecasting Class 8 tractors. Because of our longstanding work in the market, we challenge traditional market views and offer different perspectives to help you see the market in new ways.

Our work is your competitive advantage

Predictive Insights

Gain a competitive edge with our predictive insights, which empower you to forecast future market conditions accurately. This foresight allows you to shift from reactive to proactive strategies, ensuring you stay ahead of market trends and make informed decisions. With our forecasting tools, you can anticipate shifts in freight rates and capacity, allowing you to secure the best deals and optimize your operations. Stay one step ahead and deliver unparalleled service to your clients by leveraging our advanced predictive insights.

Strategic Planning

Refine your strategic planning with our in-depth analysis of specific market segments and comprehensive trend evaluations. Our data-driven approach helps you align your strategies with real-time market realities, minimizing guesswork and maximizing efficiency. By understanding market dynamics and leveraging detailed insights, you can make strategic decisions that enhance your service offerings and drive business growth. Our tools enable you to tailor your strategies to meet the ever-changing demands of the freight market, ensuring sustained success.

Risk Mitigation

Understand potential market disruptions and economic indicators to mitigate risks associated with volatile freight rates and capacity constraints. Our forecasting solutions provide a clear view of the factors that can impact your business, allowing you to develop contingency plans and avoid costly surprises. Stay resilient in the face of market volatility by using our insights to navigate uncertainties and maintain operational stability. Our tools equip you with the knowledge to mitigate risks effectively, ensuring your business remains robust and adaptable.

Operational Efficiency

Optimize your operations for cost efficiency and service quality with insights into supply-demand balance, rate trends, and sector-specific dynamics. Our forecasting solutions help you streamline your processes, reduce overheads, and improve service delivery. By understanding the intricacies of the market, you can allocate resources more effectively and enhance your operational performance. Our tools empower you to achieve higher levels of efficiency and productivity, ensuring your business operates smoothly and profitably.

ACT Research is one of the best resources you can have to make those accurate forecasts. ACT has allowed us to take what we know from our 20-plus years of business in freight brokerage and allowed us to quantify those feelings and allowed us to set the course for the business that we felt was appropriate but gave us the data to back those decisions and made us smarter in the process as well.

Christopher Thornycroft

Redwood Logistics

Updated January 26, 2026

For-Hire Carriers Face a Crossroads: Shrinking Orders, Tight Margins, and Regulatory Uncertainty

January 2026

January brings continued strain for for-hire carriers as freight volumes remain soft, rate momentum proves uneven, and policy-related cost pressures stay elevated. According to ACT Research’s January Freight Forecast and Commercial Vehicle Outlook, underlying freight activity remains weak despite weather-driven tightening late in December and early January. Pre-tariff demand has fully reversed, payback effects continue to linger, and recent spot rate gains are increasingly viewed as episodic rather than structural. While late-2025 order activity improved briefly, Class 8 demand entering 2026 remains below historical norms, underscoring ongoing fleet caution.

For-hire carriers—particularly public TL fleets—continue to operate at recession-level margins. Operating costs remain elevated, while pricing power is still limited despite accelerating capacity contraction beneath the surface. Private fleet capacity, though beginning to slow or reverse in select areas, continues to weigh on for-hire volumes. As a result, most carriers remain firmly in a “preserve and optimize” posture, emphasizing liquidity, utilization, driver productivity, and network discipline over growth.

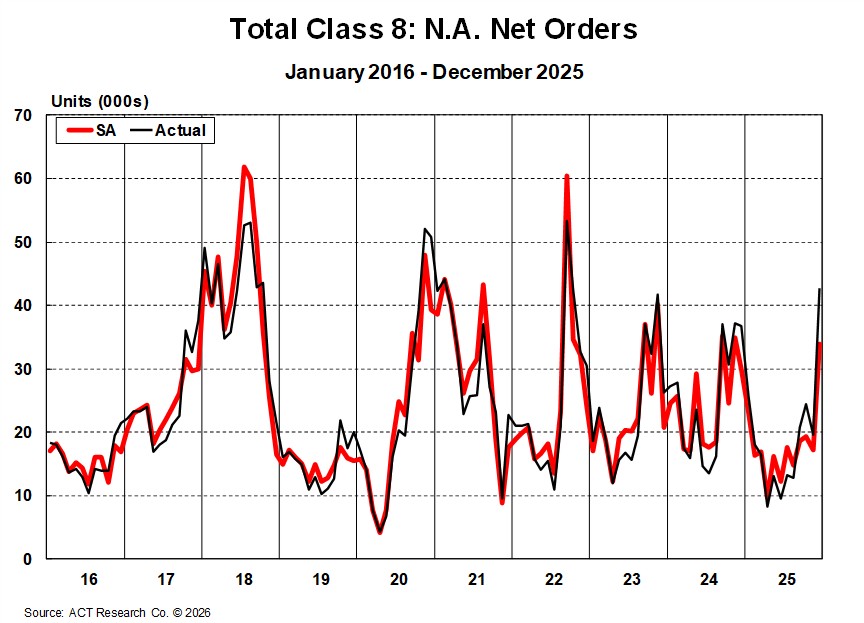

Class 8 Orders Signal Cautious Fleet Behavior

Late-2025 Class 8 order activity rebounded sharply in December, but ACT Research views that surge as a catch-up event rather than confirmation of sustained momentum. Entering 2026, orderboards remain thin relative to historical cycle norms, and fleet commitments continue to reflect a defensive stance. OEMs remain disciplined, managing daily build rates conservatively as inventories—particularly in vocational segments—remain slow to normalize.

Fleet purchasing behavior remains focused almost exclusively on replacement strategies, constrained by weak profitability, tariff-driven equipment cost inflation, and elevated financing and insurance expenses. Regulatory clarity around EPA 2027 has improved further entering 2026, with stronger indications that technology requirements will remain while extended warranty provisions may be revised or removed. Even so, higher equipment prices beginning in 2027 now appear increasingly likely.

Used truck values remain under pressure entering the new year, reflecting lingering oversupply and uneven freight demand. While newer equipment is holding value better than older units, wholesale and auction pricing remains soft, reinforcing cautious capital allocation.

Replacement purchases remain tactical. Fleets continue extending trade cycles, utilizing short-term leasing, and deferring discretionary upgrades to preserve balance-sheet flexibility. With margins still compressed, capital spending remains defensive and tightly controlled.

Profitability Hinges on Network Control and Cost Discipline

With spot rates spiking briefly in late December and early January on winter weather disruptions—but already showing signs of easing as conditions normalize—carrier profitability continues to depend heavily on operational execution. ACT data indicate freight softness remains broad-based, spanning consumer goods, imports, and industrial freight. Relative stability persists in food, healthcare, and select infrastructure- and utility-related lanes, but these pockets remain insufficient to drive a broad recovery.

Carriers maintaining relative profitability continue to emphasize:

- Route and lane rationalization to reduce empty miles

- Driver and equipment utilization improvements

- Tight fuel, insurance, and maintenance cost controls

- Active customer and freight-mix management to protect yield

Insurance, maintenance, and financing costs remain elevated, reinforcing the importance of efficiency gains. In the current environment, even modest improvements in utilization, routing, or network balance can materially impact financial performance.

EPA 2027: Delay Doesn’t Equal Dismissal

Regulatory risk remains a central strategic concern. January updates reinforce expectations that the EPA intends to retain core low-NOx technology requirements while revising or removing extended warranty provisions. While this reduces uncertainty, it also confirms that higher equipment costs beginning in 2027 are increasingly locked in. Fleets recognize that regulatory risk is shifting rather than disappearing, with potential state-level or regional requirements still possible.

Leading fleets are responding by:

- Evaluating segments most exposed to 2027 cost increases

- Engaging OEMs early on 2027-spec pricing and availability

- Maintaining ZEV pilot programs in targeted applications

- Strengthening credit lines and financing flexibility

The objective remains optionality rather than early adoption—preserving the ability to act as policy clarity and market conditions evolve.

Outlook: Tactical Patience, Strategic Preparation

ACT Research’s January reports reinforce a consistent message: freight conditions are stabilizing gradually, but not improving fast enough to justify aggressive expansion. Weather-driven volatility has not altered the underlying demand picture, and tariff-related cost inflation continues to pressure both carriers and equipment buyers.

For-hire carriers must continue balancing near-term caution with longer-term preparation. Those navigating the current environment with cost discipline, operational focus, and proactive regulatory planning will be best positioned as capacity contraction continues and freight fundamentals slowly improve.

In this transition phase, patience remains positioning—not paralysis.

Carriers that optimize networks, manage capital tightly, and prepare for the next regulatory and demand inflection will be best positioned as conditions reset heading toward 2027 and beyond.

For-hire trucking's overcapacity problem—and its eventual solution (4:36 minute watch)

5 Reasons You Should Choose ACT Research

Choosing ACT Research for your freight rate forecasting means partnering with industry leaders renowned for their precision and insight. Our forecasting solutions are built on unparalleled data accuracy and deep market analysis, providing you with the tools to stay ahead of market trends.

- Proprietary Data

- Methodology

- Human Intelligence

- Track Record of Success

- Trusted by Industry Leaders

Market Guidance for Carriers & Fleets

Unlock the power to predict and prosper. ACT's precision analytics arm carriers like you with unparalleled foresight into freight rate trends, enabling you to make informed decisions about fleet management, route planning, and service offerings based on current trends and future projections in their specific sectors. Get ahead, stay ahead, and turn market volatility into your competitive edge.

Drive Your Fleet to Success with ACT Research’s Premium Market Insights

| You want actionable supply and demand insights for carriers. Get it with fractional market intelligence services tailored specifically for the logistics and transportation brokerage sector, providing access to expert, data-driven insights and forecasts on commercial vehicle demand, market trends, freight rates, and volume forecasting. Our service enables carriers to leverage the benefits of having an elite market intelligence team at a fraction of the cost of a full-time in-house team. With ACT Research, SVPs of Finance, VPs of Pricing, Equipment, Procurement, and Market Intelligence, and CFOs can |

- Make informed strategic decisions with up-to-date, comprehensive market analyses and forecasts.

- Optimize pricing and procurement strategies by understanding current and future market conditions.

- Enhance competitive positioning by anticipating market shifts and adjusting strategies accordingly.

- Achieve better financial outcomes through data-driven insights that support effective risk management and opportunity identification.

We use this data [from ACT Research] to extract and share these insights with our carriers and shippers…We also use this data in building our internal dashboards, key variables we track, and we found out that a lot of the data points we receive from ACT Research are actually very relevant to our macroeconomic analysis in general.

Mazen Danaf

Uber Freight

Trusted by more than 400 customers for over 35 years.

- Truck OEMs

- Trailer OEMs

- Tier 1 Suppliers

- Tier 2 Suppliers

- Rental & Leasing

- Carriers & Fleets

- Shippers

- Brokers

- Dealers

- Finance Firms

- Investors

Frequently Asked Questions

The freight rate and volume forecasts are updated monthly on or near the 13th of the month (depending on if the 13th falls on a weekend). Due to our partnership with Cass Information Systems, we publish the latest forecast immediately after Cass publishes the Cass Index Report. This ensures that the latest Cass data is available first to Cass customers before our forecast of the Cass data is made available.

Up to four (4) user seats with access to the portal come with your service. Additional seats may be purchased for an additional $60 per person per seat.

Agreements with ACT Research to access our solutions are for 12 months from the date of the agreement.

We provide access to the insights and downloadable files through a portal on actresearch.net.

The forecast is a 3-year outlook, broken down into monthly buckets, updated monthly.

The legacy Class 8 tractor OEMs (Volvo, Daimler, PACCAR, and Navistar) have provided their backlog, builds, new orders, cancelations, net orders, inventory, and retail sales on the second business day of each month since 1986.

Drive Your Fleet to Success with ACT Research’s Premium Market Insights

By partnering with ACT Research, carriers can achieve better financial outcomes through data-driven insights supporting effective capacity management and identification of opportunities and navigating the complexities of the logistics and transportation market with confidence, ensuring you remain agile, informed, and ahead of the competition. Our fractional market intelligence service not only aligns with the fluctuating needs of the industry but also provides a cost-effective solution for accessing specialized expertise and insights, empowering carriers to make strategic decisions that drive growth and profitability.