Investors & Financiers

Actionable Insights for Strategic Investments in the Commercial Vehicle Market

For 40 years, ACT Research has delivered predictive insight from the heart of the commercial-vehicle industry — now you get that same vantage point. With data from OEMs, and forecasts on next-gen powertrains, freight volumes and market cycles, we give investors the clarity to anticipate risk, capture opportunity and prepare for what’s next.

Get Transportation IntelligenceLooking to anticipate market direction or enrich your own investment models with reliable data? ACT Research empowers investors like you with exclusive, data-backed insights directly from the truck, tractor, and trailer manufacturing sectors. With our comprehensive market indicators and forecasting expertise, you'll gain a unique vantage point to make informed, strategic investment decisions in an ever-evolving commercial vehicle landscape.

- Economic & Freight Indicators: Market data on industry demand and economic conditions.

- Future-Ready Forecasting: Insights into Class 4-8 production, alternative powertrains, and clean tech trends.

- Market Health & Risk Analysis: Critical market indicators and competitive landscape to guide risk-adjusted returns.

- Comprehensive Regulatory Outlook: Stay ahead of emissions regulations and compliance shifts.

“I would recommend ACT as your number 1 ‘go to’ source for industry forecasts and just general industry knowledge…You cannot follow this industry, be part of this industry without knowing what ACT Research is saying….”

Mike Zimm

BMO

What It Offers: A Data-Driven Feature Set for Investors

ACT Research’s insights empower investors with the data needed to track, anticipate, and capitalize on trends across the commercial vehicle market. Our feature set equips you with visibility into production cycles, demand fluctuations, and emerging technologies, enabling informed investment choices.

- Market Trends & Sector Health: Quarterly and annual reports on demand cycles, production backlogs, and capital equipment investment indicators across Class 4-8 trucks, essential for gauging market stability and growth potential.

- Alternative Powertrain Forecasting: Detailed forecasts on battery-electric, hydrogen, and natural gas vehicles, identifying high-growth opportunities within clean technology and sustainability sectors.

- Economic & Freight Index Reports: Comprehensive analysis of economic indicators, freight trends, and freight rate movements, providing critical data to assess demand potential and revenue growth.

- Competitive Landscape & M&A Insights: Insightful overviews of OEMs and broader trends within the commercial vehicle ecosystem, supporting well-informed investment and acquisition strategies.

Who Benefits? A Broad Investor Audience Seeking Actionable Market Insights

Investors across sectors gain from ACT Research’s market intelligence, from capital finance and private equity firms to sustainability-focused funds. Our data provides a competitive edge, offering deep insights into the market’s current and future state.

- Capital Finance Companies: Strategically evaluating market demand cycles, production forecasts, and capital equipment trends to guide financing solutions and investments in transportation assets.

- Private Equity and Venture Capital Firms: Identifying growth areas and technology innovations, particularly in zero-emission vehicle (ZEV) adoption and alternative powertrains.

- Portfolio Managers and Financial Analysts: Leveraging production and freight movement insights to inform portfolio allocations and monitor performance.

- Sustainability-Focused Funds: Tracking adoption of clean technologies and infrastructure to align with environmental, social, and governance (ESG) goals.

- Hedge Funds and Institutional Investors: Capitalizing on industry cycles by anticipating shifts in fleet demand, regulatory impacts, and vehicle production trends.

We Focus on 3 Things

Our transportation intelligence solutions give you actionable supply and demand insights to make better, smarter decisions for your business, not as a vendor or tool, but as a partner in your process.

ACT Methodology

ACT has been providing historically accurate Class 8 tractor forecasts, trusted for more than 35 years by Fortune 500 companies, Wall Street's largest investment firms, commercial vehicle equipment manufacturers and suppliers, rental and leasing firms, and others. Serving the commercial vehicle equipment market for decards, we bring this Class 8 tractor understanding to you, giving a supply and demand-focused, balanced, strong, and flexible foundation of analysis.

ACT Proprietary Data

It starts with an exclusive view of Class 8 trucks and tractor splits, providing clarity on the Class 8 tractor capacity. ACT Research is the only company receiving this information monthly directly from the North American truck OEMs (Daimler, PACCAR, Volvo, Navistar). Separating Class 8 straight trucks and Class 8 tractors gives us (and you) visibility into two important pieces of the supply of Class 8 equipment for the freight markets:

1) The number of new Class 8 Tractors Retail Sales, which means new tractors entering the fleet.

2) The change in the active population of the Class 8 Tractor, measuring the total working fleet.

ACT Human Intelligence

Our team isn't just experienced; they're seen as the leaders in forecasting demand for commercial vehicles. We bring you insights from the only transportation intelligence company with more than 250 years of combined experience in forecasting Class 8 tractors. Because of our longstanding work in the market, we challenge traditional market views and offer different perspectives to help you see the market in new ways.

What Our Investors & Financier Customers Rely On:

North America Commercial Vehicle Outlook

Industry-Leading Forecasts to Support Strategic Decisions

What It Offers:

- Class 4-8 Vehicle Forecasts: Get a comprehensive view of vehicle demand trends across trucks and trailers over the next 1, 5, and 10 years.

- Economic and Industry Drivers: Analyze key economic factors driving the commercial vehicle industry.

- Population Composition and Demand Trends: Insights into population models, active fleet, and age.

Who Benefits?

- OEMs and Tier 1 suppliers aligning production capacity with market demand.

- Financial and investment firms tracking industry performance.

- Fleet managers and CFOs optimizing vehicle acquisition strategies.

North America Commercial Vehicle Outlook Plus

Comprehensive Decarbonization Insights for a Zero-Emission Future

What It Offers:

- NA Commercial Vehicle Outlook: Everything in the monthly NA CV Outlook update.

- ZEV Adoption Forecasts: Detailed, bottom-up forecasts for battery-electric, hydrogen fuel cell, and natural gas vehicles, focusing on Classes 4-8 trucks.

- Infrastructure Readiness Analysis: Coverage and analysis of EV charging and hydrogen refueling station development.

- Regulatory Compliance: Detailed timelines and insights into U.S. and Canadian emissions regulations (CARB, EPA), helping you stay ahead of upcoming mandates.

Who Benefits?

- Fleet managers and CFOs planning for ZEV adoption and infrastructure investments.

- OEMs and Tier 1 suppliers focusing on new propulsion systems and regulatory alignment.

- Shippers and logistics providers seeking to meet sustainability targets while maintaining operations.

U.S. Used Truck Price Forecast

In-Depth Forecasting for U.S. Used Truck Prices

What It Offers:

- Monthly Used Truck Price Forecasts: Accurate, up-to-date forecasts on used truck pricing trends of Class 8 Tractors by age and mileage groups, helping stakeholders anticipate price fluctuations and market cycles.

- Economic and Market Influencers: Analysis of key economic drivers and market conditions affecting used truck prices, such as freight demand, new truck availability, and macroeconomic indicators.

- Inventory and Resale Value Insights: Data on inventory levels and resale value trends, providing critical context for pricing expectations and helping to assess the long-term value of used trucks.

Who Benefits?

- Dealers and Resellers forecasting pricing to optimize inventory acquisition and resale strategies for different truck classes and age groups.

- Fleet Managers and Procurement Teams planning fleet acquisitions or sales based on anticipated pricing trends to maximize value and reduce total cost of ownership.

- Financial Analysts and Investors evaluating the used truck market as an indicator of transportation sector health and potential investment opportunities.

- Lenders and Finance Companies assessing truck values to better structure financing options and manage residual risk.

Freight & Transportation Forecast

TL, LTL, & Intermodal Rate & Volume Forecast

What If Offers:

1. TL Contract & Spot Rate Forecasts: Broken down by Reefer, Flatbed, & Dry Van

2. Cass Shipments & Truckload Linehaul® Indexes Forecasts: Since 2019 Cass & ACT has partnered to provide deeper insights into the TL volumes.

3. ACT Freight Composite Index Forecast: A freight-weighted GDP measure of the economic activity generating freight.

4. LTL & Intermodal Rate and Volume Forecasts: Coverage of and forecasts of the LTL and Intermodal sectors of the market that move freight.

5. ACT For-Hire Survey Indexes: A look at life from the perspective of truckers with our For-Hire Survey Indexes covering topics from rates to drivers to equipment.

Who Benefits?

- Fleet Managers and Operations Directors managing capacity and pricing strategies in response to market shifts and freight rate fluctuations.

- CFOs and Financial Analysts optimizing budgets and planning for capital investments based on demand forecasts and freight trends.

- OEMs and Tier 1 Suppliers developing products and forecasts aligned with freight demand and industry cycles.

- Shippers and Logistics Providers aiming to balance cost efficiency with timely delivery in an unpredictable market.

- Investment Analysts and Market Researchers assessing freight sector health and guiding strategic investments for stakeholders.

- Freight Brokers and Third-Party Logistics (3PL) Providers adjusting pricing models and service offerings in line with freight rate trends and capacity indicators.

North America Classes 5-8 Vehicles

Comprehensive Market Intelligence on North American Class 5-8 Vehicles

What It Offers:

- Monthly Production and Sales Data: In-depth coverage of monthly production, sales, and inventory levels for Class 5-8 trucks, providing critical insights into current and projected market conditions.

- Order Backlogs and Cancellation Rates: Detailed analysis of order backlogs, cancellation rates, and their implications for future demand, supporting accurate assessments of market momentum.

- Insights on Supply Constraints: Up-to-date information on supply chain pressures affecting Class 5-8 production, from parts shortages to labor availability, helping stakeholders manage and anticipate impacts on production timelines.

Who Benefits?

- OEMs and Tier 1 Suppliers optimizing production planning and adjusting to supply chain conditions based on total market data.

- Fleet Owners and Equipment Managers evaluating market trends to make informed decisions on fleet expansion, replacement, and capital investments.

- Logistics Companies and Freight Brokers monitoring equipment availability and market demand to plan capacity needs effectively.

- Investors and Analysts seeking data-driven insights into the performance and trajectory of the Class 5-8 market to guide investment strategies.

NA OEM Classes 5-8 Build & Retail Sales

Detailed Build and Retail Sales Data for North American Commercial Vehicles

What It Offers:

- Production and Retail Sales Tracking: Monthly updates on build rates and retail sales figures for Class 5-8 commercial vehicles, providing a clear snapshot of the market’s production output and sales performance.

- Market Comparisons Across Classes: Comparative analysis across Class 5-8 vehicle segments, offering nuanced insights into performance differences and trends within each vehicle class.

Who Benefits?

- OEMs and Suppliers optimizing production and inventory planning based on accurate build and retail data.

- Dealers and Distributors assessing market demand to align inventory with retail trends and improve stock management.

- Fleet Operators and Procurement Teams using production and sales insights to time acquisitions and optimize fleet investments.

- Investors and Analysts tracking sales and production data as leading indicators of the commercial vehicle market's health and growth potential.

Updated January 26, 2026

Investor Sentiment Turns Defensive as Freight Weakness Extends and Equipment Orders Lag

With freight fundamentals remaining soft entering 2026 and equipment investment still constrained, investor sentiment continues to skew defensive following a year defined by margin management rather than growth. Demand visibility remains limited, and while several policy and macro catalysts could shift sentiment later in the year, the near-term environment remains characterized by caution, balance-sheet preservation, and selective positioning.

ACT Research’s January N.A. Commercial Vehicle Outlook and Freight Forecast continue to show a market weighed down by uneven freight volumes, below-replacement Class 8 demand outside of a late-2025 catch-up surge, and defensive fleet spending behavior. While winter weather disruptions in late December and early January briefly lifted spot rates, ACT continues to characterize this strength as episodic and event-driven rather than structural. Carrier profitability remains near recessionary levels entering 2026, reinforcing capital discipline across the sector.

For investors, the message remains consistent: performance through early 2026 will hinge on margin durability, working-capital control, and financial flexibility—not volume acceleration or top-line growth.

Key Takeaways for Investors

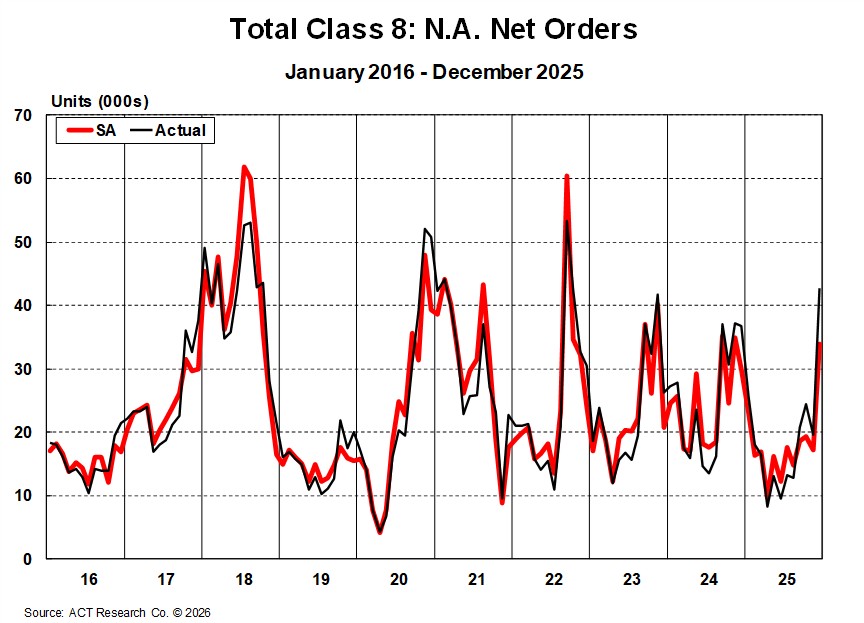

1. Class 8 Orders Remain Weak, Signaling Persistent Capital Caution

While December 2025 Class 8 orders rebounded sharply, ACT Research views that activity as a catch-up event rather than confirmation of a sustained recovery. On a rolling basis, Class 8 orders entering 2026 remain well below historical cycle norms, and forward orderboards continue to reflect limited fleet commitment. OEMs remain focused on production discipline, keeping output aligned with replacement-level demand. Tractor inventories have improved, while vocational inventories remain elevated and slower to correct.

This softness continues to reflect entrenched caution:

Carrier margins remain at recession-level lows.

§232 heavy-vehicle tariffs are fully embedded in equipment pricing.

EPA 2027 clarity has improved, but higher equipment prices now appear increasingly unavoidable.

Supplier sentiment remains cautious, with quoting activity selective, sales cycles extended, and order pipelines thin.

For investors, this implies continued revenue pressure for OEMs into early 2026—offset by tighter inventory control, disciplined cost management, and improved working-capital performance relative to prior downturns.

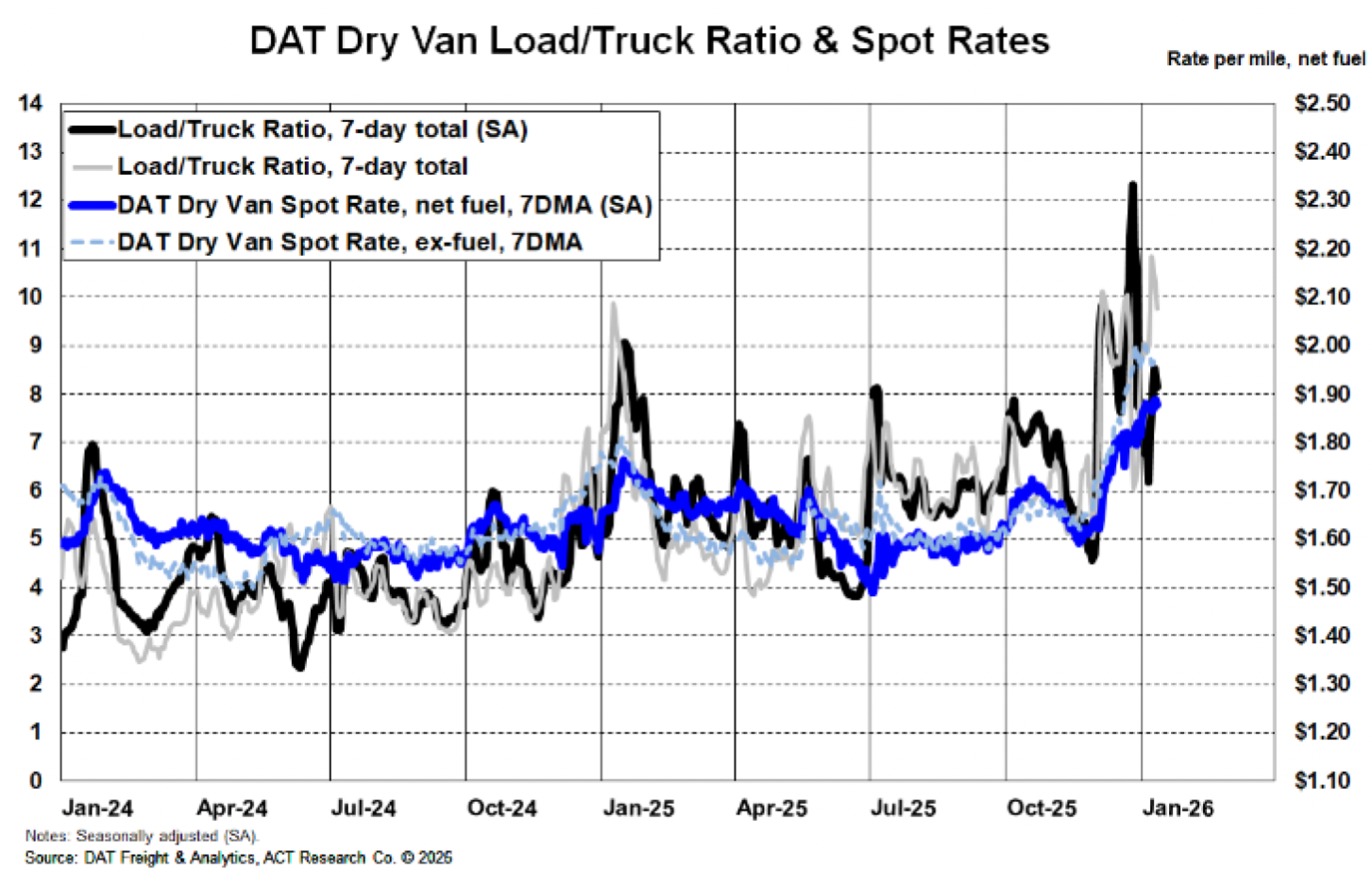

2. Freight Volumes Flat, with No Clear Inflection Yet

ACT’s January Freight Forecast shows for-hire freight volumes continuing to track largely sideways as pre-tariff payback effects linger and goods-oriented demand remains soft. Consumer freight remains uneven, industrial volumes show limited momentum, and imports and intermodal activity continue to lag year-ago levels.

While late-December and early-January weather disruptions created short-term spot-rate volatility, underlying pricing power remains limited. Contract rates remain largely flat, and public TL carriers continue to face margin pressure. Investors should expect transportation equities to rely primarily on cost discipline, asset utilization, and network efficiency rather than demand-driven upside in the near term.

3. EPA 2027 Uncertainty Still Delaying Prebuy – Policy Catalysts in Focus

EPA 2027 remains the sector’s most important policy variable. January updates reinforce expectations that the EPA will retain core emissions technology requirements while removing or revising extended warranty provisions. This has reduced regulatory uncertainty but confirmed structurally higher equipment prices beginning in 2027.

As a result, prebuy activity remains muted rather than accelerating.

However, ACT continues to view a compressed prebuy window in 2026 as a plausible upside scenario if regulatory clarity arrives abruptly or financing conditions improve. Such a shift could drive a sharp, short-duration surge in Class 8 demand—benefiting OEMs, key suppliers, and financially stronger fleets positioned to secure early production slots.

For investors, regulatory clarity remains the single most significant upside catalyst for the commercial vehicle sector over the next 12 months.

4. Pricing Power Shifts Downstream as OEM Margins Compress

Tariff-driven cost inflation remains embedded, raising acquisition costs and pressuring OEM margins as demand remains subdued. With freight volumes soft and financing costs elevated, OEMs continue to prioritize throughput stability and backlog quality, limiting near-term margin expansion entering 2026.

Pricing leverage has shifted decisively downstream:

Large fleets continue to benefit from negotiating power.

Component suppliers face margin pressure as order pipelines remain thin.

Investors should favor companies with strong cash conversion, variable-cost flexibility, and limited reliance on high-cost credit markets.

Bottom Line: A Holding Pattern That Rewards Discipline

January data reinforces a “flat but fragile” outlook across freight and equipment markets. Growth remains elusive, but balance sheets are generally stronger and cost structures leaner than in prior cycles.

For investors, this remains a positioning cycle—not a volume cycle. Capital should favor companies with:

Strong free cash flow generation

Flexible production or service models

Balance-sheet strength ahead of regulatory and macro inflection points

Exposure to infrastructure-aligned or less cyclical freight segments

Until freight demand stabilizes more meaningfully or EPA 2027 clarity triggers renewed fleet investment, performance will be dictated by margin control, efficiency, and adaptability.

The sector is waiting—but those positioned for agility and resilience will capture the next upturn first.

Want to hear more from ACT Research? Analysts Lydia Vieth and Ann Rundle explain the current market and regulations, as well as their projections for future electric truck adoption, battery technologies, and beyond.

Where's the electric truck market headed now? (12:56 minute watch)

5 Reasons You Should Choose ACT Research

Choosing ACT Research for your market insights and forecasting means partnering with industry leaders renowned for their precision and insight. Our forecasting solutions are built on unparalleled data accuracy and deep market analysis, providing you with the tools to stay ahead of market trends.

- Proprietary Data

- Methodology

- Human Intelligence

- Track Record of Success

- Trusted by Industry Leaders

Market Guidance for Dealers & Leasing Companies

Unlock the power to predict and prosper. ACT's precision analytics arm companies like yours with unparalleled foresight into market trends, enabling you to master market swings, navigate demand changes, manage inventory risk, and boost profitability . Get ahead, stay ahead, and turn market volatility into your competitive edge.

Drive Your Company To Success with ACT Research's Premium Market Insights

By partnering with ACT Research, dealers and leasing firms gain the advantage of data-driven insights to support effective risk management, uncover new opportunities, and confidently navigate the complexities of the transportation market. Our market intelligence services not only aligns with the fluctuating needs of the industry but also provides a cost-effective solution for accessing industry expertise and insights, empowering dealers and leasing companies to make strategic decisions that drive growth and profitability.