Manufacturers

Empowering Manufacturers with Data-Driven Insights

As the leading source for commercial vehicle market data and forecasts, ACT Research provides manufacturers with the intelligence they need to stay ahead of market trends, optimize production, and drive profitability. Our comprehensive data and insights empower manufacturers to make informed decisions at every stage of the production cycle, from supply chain planning to market entry strategies.

Get Transportation IntelligenceManufacturers across North America trust ACT Research for accurate, timely, and actionable insights. Our data-driven approach provides a clear view of market dynamics, helping you anticipate shifts and capitalize on opportunities. Here’s how we support your business:

- Forecasting Precision: Predict future demand with confidence using our industry-leading forecasts for Class 8 and medium-duty trucks, trailers, and more.

- Market Analysis: Stay informed with detailed analysis of industry trends, production schedules, and market fluctuations.

- Production Optimization: Leverage our insights to fine-tune manufacturing schedules and adjust inventory based on real-time demand data.

I would recommend ACT Research to anyone that’s looking for in-depth insight into what’s happening in the commercial vehicle markets. The expertise and knowledge that goes into the service they provide, there’s not a better solution, in my opinion, for commercial vehicle data than ACT Research.

Jeff Trent

Mahle

Solutions for Manufacturers

For 40 years, ACT Research has helped manufacturers turn industry change into opportunity. Whether you’re planning production for the next powertrain cycle or optimizing supply chains amid regulatory shifts, we deliver forecasting grounded in decades of insight. Different tools. Same mission: clarity in complexity

Production Planning & Forecasting

Stay ahead of market shifts with our robust forecasting tools. ACT Research delivers monthly updates and long-term projections that help manufacturers anticipate demand changes, optimize production cycles, and go-to-market strategies.

Supply Chain Insights

Access real-time data to identify bottlenecks, assess supplier risk, and adapt to disruptions. Our supply chain insights ensure your operations remain agile and responsive to market changes.

Market Entry Strategies

Make data-informed decisions on new product introductions and market expansions. Our comprehensive market reports offer a deep understanding of key segments, allowing you to evaluate the potential of emerging opportunities.

Benchmarking & Performance Analysis

Measure your performance against industry standards. Our reports offer benchmarks across various metrics, enabling you to identify areas for improvement and drive operational excellence.

Regulatory & Compliance Data

Navigate the complexities of regulations with access to data that helps you stay compliant with federal and state requirements. We provide updates on emission standards, safety regulations, and other critical compliance issues affecting the manufacturing landscape.

We Focus on 3 Things

Our transportation intelligence solutions give you actionable supply and demand insights to make better, smarter decisions for your business, not as a vendor or tool, but as a partner in your process.

- ACT Proprietary Data

- ACT Methodology

- ACT Human Intelligence

ACT Proprietary Data

It starts with an exclusive view of Class 8 trucks and tractor splits, providing clarity on the Class 8 tractor capacity. ACT Research is the only company receiving this information monthly directly from the North American truck OEMs (Daimler, PACCAR, Volvo, Navistar). Separating Class 8 straight trucks and Class 8 tractors gives us (and you) visibility into two important pieces of the supply of Class 8 equipment for the freight markets:

1) The number of new Class 8 Tractors Retail Sales, which means new tractors entering the fleet.

2) The change in the active population of the Class 8 Tractor, measuring the total working fleet.

ACT Methodology

ACT has been providing historically accurate Class 8 tractor forecasts, trusted for more than 35 years by Fortune 500 companies, Wall Street's largest investment firms, commercial vehicle equipment manufacturers and suppliers, rental and leasing firms, and others. Serving the commercial vehicle equipment market for decards, we bring this Class 8 tractor understanding to you, giving a supply and demand-focused, balanced, strong, and flexible foundation of analysis.

ACT Human Intelligence

Our team isn't just experienced; they're seen as the leaders in forecasting demand for commercial vehicles. We bring you insights from the only transportation intelligence company with more than 250 years of combined experience in forecasting Class 8 tractors. Because of our longstanding work in the market, we challenge traditional market views and offer different perspectives to help you see the market in new ways.

Solutions for the Road Ahead

North America Commercial Vehicle Outlook Plus

Comprehensive Decarbonization Insights for a Zero-Emission Future

What It Offers:

- NA Commercial Vehicle Outlook: Everything in the monthly NA CV Outlook update.

- ZEV Adoption Forecasts: Detailed, bottom-up forecasts for battery-electric, hydrogen fuel cell, and natural gas vehicles, focusing on Classes 4-8 trucks.

- Infrastructure Readiness Analysis: Coverage and analysis of EV charging and hydrogen refueling station development.

- Regulatory Compliance: Detailed timelines and insights into U.S. and Canadian emissions regulations (CARB, EPA), helping you stay ahead of upcoming mandates.

Who Benefits?

- Fleet managers and CFOs planning for ZEV adoption and infrastructure investments.

- OEMs and Tier 1 suppliers focusing on new propulsion systems and regulatory alignment.

- Shippers and logistics providers seeking to meet sustainability targets while maintaining operations.

North America Commercial Vehicle Outlook

Industry-Leading Forecasts to Support Strategic Decisions

What It Offers:

- Class 4-8 Vehicle Forecasts: Get a comprehensive view of vehicle demand trends across trucks and trailers over the next 1, 5, and 10 years.

- Economic and Industry Drivers: Analyze key economic factors driving the commercial vehicle industry.

- Population Composition and Demand Trends: Insights into population models, active fleet, and age.

Who Benefits?

- OEMs and Tier 1 suppliers aligning production capacity with market demand.

- Financial and investment firms tracking industry performance.

- Fleet managers and CFOs optimizing vehicle acquisition strategies.

Freight & Transportation Forecast

TL, LTL, & Intermodal Rate & Volume Forecast

What If Offers:

1. TL Contract & Spot Rate Forecasts: Broken down by Reefer, Flatbed, & Dry Van

2. Cass Shipments & Truckload Linehaul® Indexes Forecasts: Since 2019 Cass & ACT has partnered to provide deeper insights into the TL volumes.

3. ACT Freight Composite Index Forecast: A freight-weighted GDP measure of the economic activity generating freight.

4. LTL & Intermodal Rate and Volume Forecasts: Coverage of and forecasts of the LTL and Intermodal sectors of the market that move freight.

5. ACT For-Hire Survey Indexes: A look at life from the perspective of truckers with our For-Hire Survey Indexes covering topics from rates to drivers to equipment.

Who Benefits?

- Fleet Managers and Operations Directors managing capacity and pricing strategies in response to market shifts and freight rate fluctuations.

- CFOs and Financial Analysts optimizing budgets and planning for capital investments based on demand forecasts and freight trends.

- OEMs and Tier 1 Suppliers developing products and forecasts aligned with freight demand and industry cycles.

- Shippers and Logistics Providers aiming to balance cost efficiency with timely delivery in an unpredictable market.

- Investment Analysts and Market Researchers assessing freight sector health and guiding strategic investments for stakeholders.

- Freight Brokers and Third-Party Logistics (3PL) Providers adjusting pricing models and service offerings in line with freight rate trends and capacity indicators.

Engine Forecast

Comprehensive Engine Production Forecast for Strategic Planning

What It Offers:

- NA Commercial Vehicle Outlook Integration: Includes all insights from the NA CV Outlook monthly update, ensuring users have a cohesive view of vehicle market trends.

- Engine Production Forecasts: In-depth, bottom-up forecasts for North American engine demand across Class 4-8 trucks, including segmentation by fuel types and powertrains.

- Market Trend Analysis: Detailed analysis of market dynamics impacting engine production, from regulatory impacts to shifts in fuel preferences.

- Emission Standards Insight: Timelines and analysis of U.S. and Canadian emissions regulations, providing foresight into compliance and future requirements.

Who Benefits?

- Engine Manufacturers and Tier 1 Suppliers planning production cycles and R&D investments to align with forecasted demand and regulatory changes.

- Fleet Managers and CFOs strategizing around fleet composition and future equipment needs based on powertrain trends.

- Policy Makers and Regulators assessing future engine production to support emissions reduction goals and compliance initiatives.

- Investment Analysts and Market Researchers evaluating the engine sector’s health and trends to guide strategic investments in the commercial vehicle market.

Updated December 26, 2026

Manufacturers Face Mixed Signals as Orders Lag and Regulatory Uncertainty Persists

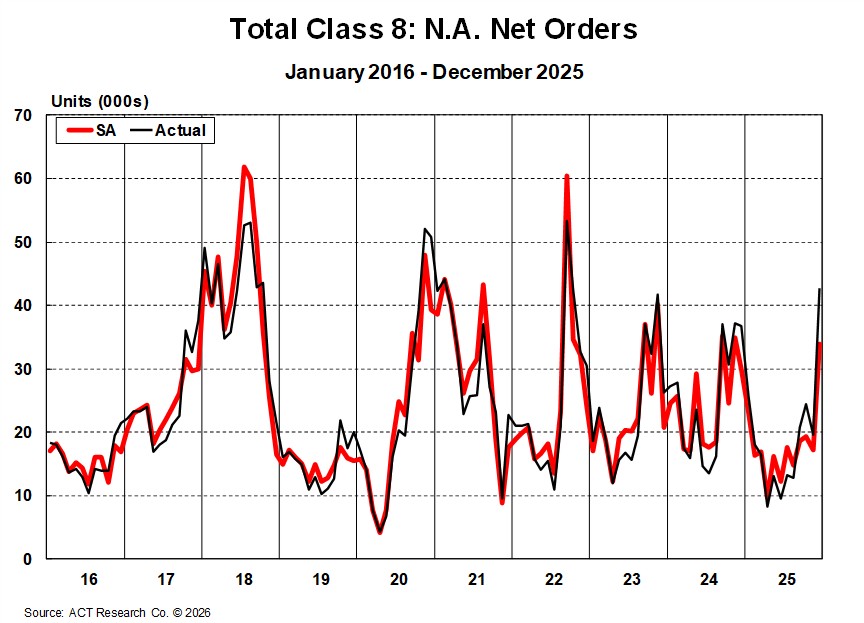

As 2026 begins, North American commercial vehicle manufacturers are navigating a market defined by conflicting signals: a sharp late-2025 rebound in Class 8 orders, continued weakness in underlying freight fundamentals, and rising confidence around regulatory structure—but not cost relief. While the December order surge improved sentiment temporarily, ACT Research’s January N.A. Commercial Vehicle Outlook confirms that demand visibility remains limited, with fleet behavior still anchored to replacement timing, cost containment, and balance-sheet preservation rather than growth.

Supply chains remain stable, and OEMs continue to report solid component availability and improved manufacturing consistency. However, quoting activity has become more selective, and order conversion rates remain uneven as fleets reassess capital plans following the year-end order volatility. Sales cycles remain elongated, and order visibility into mid-2026 remains compressed. OEM strategy continues to prioritize backlog quality, inventory discipline, and production flexibility over incremental volume, reflecting caution that the December order rebound may not translate into sustained demand.

Class 8 Orders Continue to Undershoot Expectations

December’s sharp rebound in Class 8 orders marked a notable inflection after months of underperformance, but January data reinforce ACT Research’s view that the move reflected deferred replacement decisions, regulatory clarification, and tactical catch-up rather than a true demand recovery. When viewed on a rolling basis, Class 8 orders entering 2026 remain well below historical seasonal norms and far short of levels associated with a growth cycle.

OEMs continue to manage production tightly around replacement-level demand. Build rates remain conservative, and manufacturers are carrying production restraint into early 2026 as inventories—particularly in vocational configurations—remain elevated and slow to correct. Tractor inventories have improved meaningfully, but non-tractor stock continues to weigh on scheduling decisions and dealer sentiment.

Fleet hesitation continues to be driven by:

-

Persistently weak profitability, with public TL carriers still operating at recession-level margins

-

Tariff-driven cost inflation, as §232 heavy-vehicle tariffs are fully embedded and now viewed as structural

-

Regulatory cost certainty replacing uncertainty, confirming higher future price points

Cancellation rates remain relatively contained, suggesting fleets are largely honoring limited replacement commitments rather than retrenching. Long-haul tractor demand remains the softest segment, while vocational demand continues to show selective resilience tied to utilities, data centers, and municipal activity—though still well below prior-cycle peaks.

Prebuy Activity Remains Muted as Regulatory Clarity Improves—but Costs Rise

EPA 2027 clarity improved further entering January, reducing uncertainty around rule structure while confirming higher equipment costs ahead. Industry guidance continues to indicate that core low-NOx technology requirements will remain, while extended warranty and useful-life provisions are likely to be revised or removed. This shift has narrowed planning scenarios but reinforced expectations for materially higher sticker prices beginning in 2027.

Despite this clarity, prebuy activity remains restrained. January discussions indicate fleets are increasingly modeling scenarios rather than acting on them, constrained by weak margins, higher interest rates, and tighter credit conditions. Fleet decision-makers continue to seek greater confidence around:

-

Final OEM pricing strategies and cost pass-through

-

Certification timing and build slot availability

-

Residual value implications for pre-2027 equipment

-

Financing capacity amid elevated borrowing costs

Manufacturers remain in a heightened state of regulatory readiness—finalizing spec pathways, coordinating with suppliers, and maintaining scheduling flexibility—but orderbooks still show little evidence of broad-based prebuy acceleration. Improved clarity has changed planning conversations, but not purchasing behavior.

Medium-Duty and Vocational Segments Show Relative Stability

Compared to long-haul Class 8 tractors, medium-duty and vocational segments continue to offer relative stability entering 2026. Activity improved modestly late in 2025 and has held steadier into January, supported by municipal replacement cycles, utility work, and essential service distribution.

Key stabilizing drivers continue to include:

-

Municipal and utility budget execution

-

Food, beverage, and service-related distribution demand

-

Infrastructure-, utility-, and data-center-linked vocational activity

That said, demand remains below historical norms, and inventories—particularly in medium-duty—remain elevated despite disciplined production. Body-builder throughput continues to be uneven across configurations, reinforcing OEM emphasis on spec discipline, lead-time management, and lifecycle value rather than price competition.

Outlook: A Strategic Reset Year Extends into 2026

December data reinforces that 2025 has remained a reset year for manufacturers—defined by discipline, flexibility, and margin protection rather than expansion. OEMs continue operating through the trough with a focus on cost control, backlog integrity, and agile output management.

Core imperatives for manufacturers heading into 2026 include:

Maintaining strict build alignment with replacement-level demand

Managing inventories conservatively to avoid speculative production

Preserving production flexibility as EPA 2027 specs and pricing solidify

Deepening fleet engagement to support cautious buyers and protect future pipelines

Until freight fundamentals improve more meaningfully and the benefits of capacity contraction translate into stronger carrier profitability, manufacturers are likely to remain in defensive mode. Those that protect margins, maintain flexibility, and strengthen fleet relationships during this slow cycle will be best positioned to capture demand quickly once confidence, clarity, and capital availability return.

Want to hear more from ACT Research? Analysts Lydia Vieth and Ann Rundle explain the current market and regulations, as well as their projections for future electric truck adoption, battery technologies, and beyond.

Where's the electric truck market headed now? (12:56 minute watch)

5 Reasons You Should Choose ACT Research

Choosing ACT Research for your market insights and forecasting means partnering with industry leaders renowned for their precision and insight. Our forecasting solutions are built on unparalleled data accuracy and deep market analysis, providing you with the tools to stay ahead of market trends.

- Proprietary Data

- Methodology

- Human Intelligence

- Track Record of Success

- Trusted by Industry Leaders

Market Guidance for Dealers & Leasing Companies

Unlock the power to predict and prosper. ACT's precision analytics arm companies like yours with unparalleled foresight into market trends, enabling you to master market swings, navigate demand changes, manage inventory risk, and boost profitability . Get ahead, stay ahead, and turn market volatility into your competitive edge.

Drive Your Company To Success with ACT Research's Premium Market Insights

By partnering with ACT Research, dealers and leasing firms gain the advantage of data-driven insights to support effective risk management, uncover new opportunities, and confidently navigate the complexities of the transportation market. Our market intelligence services not only aligns with the fluctuating needs of the industry but also provides a cost-effective solution for accessing industry expertise and insights, empowering dealers and leasing companies to make strategic decisions that drive growth and profitability.