Shippers

See the Future of Freight

Anticipate market cycles with confidence. Trusted by shippers who demand more than guesswork, forward-looking insights keep you informed, agile, and ahead.

Get A PDF Preview: US, Canada, and Cross-Boarder Rate & VolumeStill reacting instead of planning ahead?

You’re not alone. Many logistics leaders are blindsided by market volatility, stuck reacting while crucial budget dollars vanish. Is this you?

Sudden Rate Spikes?

Your budget hammered by unexpected increases, leaving you scrambling.

Capacity Crashes?

Struggling to secure freight because you couldn't see the crunch coming.

Spreadsheet Chaos?

Drowning in fragmented data, making smart decisions impossible.

Lost Confidence?

Every forecast feels like a coin toss, leaving your long-term plans vulnerable.

November 2025 Update

Chaos Is Cash—For the Shippers Who Prepare

Master Your Future. Control Your Costs.

Freight Forecast: Rate & Volume Outlook isn't just data – it's your strategic weapon against market uncertainty. We give you the power to:

- PREDICT WITH PRECISION: Confidently plan 12-36 months ahead. Slash surprises and optimize budgets by an average of 5-10%.

- PROACTIVE PROCUREMENT: Align carrier contracts with actual capacity shifts. Secure better rates, even in volatile markets.

- MITIGATE RISK, MAXIMIZE PROFIT: Identify potential disruptions before they hit. Protect your margins and gain a competitive edge.

- OPERATIONAL EFFICIENCY: Streamline your processes, reduce overheads, and improve service delivery.

The Industry’s Most Trusted Forecast.

Decades of precision. Unrivaled expertise. Our forecasts are the bedrock for critical decisions made by logistics leaders across North America.

35+ Years of Industry Expertise

Proprietary Data

Methodology

Assuring rail equipment capacity for our intermodal stakeholders is imperative at TTX Company. Meeting this goal requires accurate freight demand forecasting which, in turn, necessitates an understanding of market conditions and issues. ACT Research’s monthly Freight Forecast complements our internal research and analysis by providing keen insight on demand drivers, as well as emerging and evolving trends. The report’s content is well-written, and the information provided is organized and easy to access and interpret.

Frank Adcock

AVP Marketing, TTX Company

Why Settle for Less? Get Unrivaled Accuracy

Go beyond guesswork. Access the deepest, most actionable freight intelligence available anywhere.

This isn't just another report. Freight Forecast: Rate & Volume Outlook is your unfair advantage, built on a foundation of proprietary data and 35+ years of predictive modeling. Inside, you get:

- Future-Proof Planning: Unprecedented 36-month outlooks on volume and contract rates. See three years (2025-2027) ahead, so you can outmaneuver competitors and secure long-term stability.

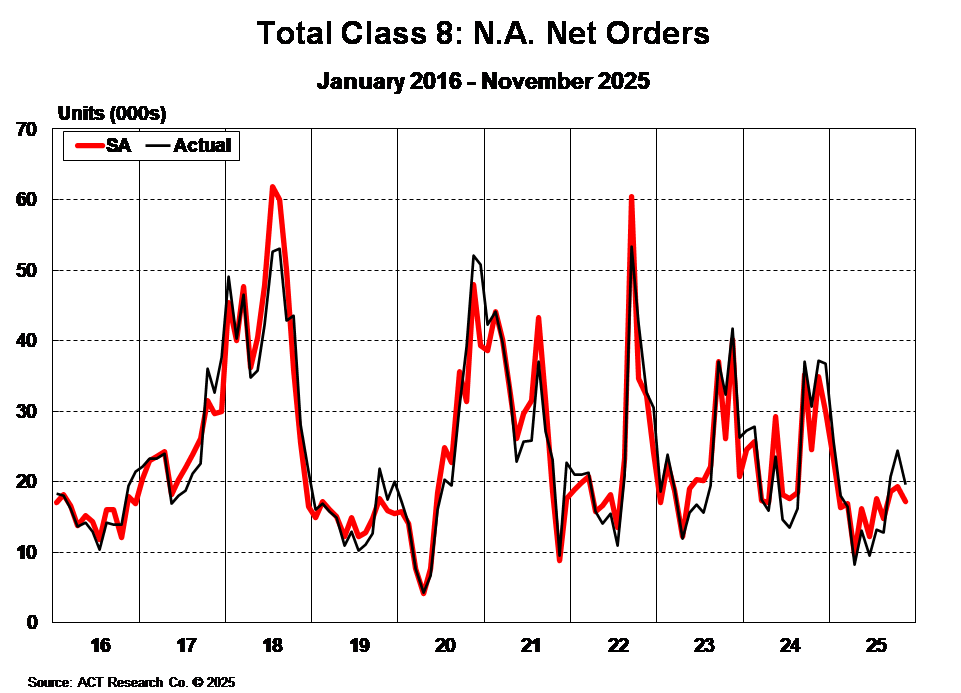

- The Power of Class 8: Our forecasts are rooted in ACT Research's historically accurate Class 8 tractor demand model – the industry's gold standard. Understand true capacity shifts before anyone else, so you can optimize your entire network.

- Holistic Market View: Integrates key economic indicators with granular freight data. Grasp the full market picture, so you can mitigate risk and capitalize on emerging trends.

- Benefits from ACT’s exclusive partnership: Our partnership with DAT Freight & Analytics gets you more detail on contract and spot rates, volumes, loads, and equipment postings so you can have more detail on market trends.

Updated December 22, 2025

Chaos Is Cash—For the Shippers Who Prepare

With freight markets still soft, recent rate firmness driven by winter weather rather than demand, and fleet investment remaining constrained, shippers that prepare now will outperform when volatility returns. Beneath the surface calm, structural pressures continue to build across equipment supply, tariffs, and regulatory timelines—setting the stage for meaningful capacity dislocation once freight demand stabilizes.

ACT Research’s December data shows the market still working through a payback phase following the pre-tariff surge of mid-2025. While spot rates spiked briefly in early December due to weather disruptions, underlying fundamentals remain weak. Contract rates remain largely flat, and capacity continues to outweigh freight volumes despite accelerating fleet contraction. Meanwhile, Class 8 production has been cut sharply, backlogs are stabilizing due to lower build rates, trailer backlogs remain near historic lows, and EPA 2027 cost impacts are becoming clearer.

For shippers, this quiet phase remains a strategic advantage window. The market’s apparent stability is temporary—those who benchmark, renegotiate, and strengthen network resilience now will control cost and capacity later.

Use Current Rate Stability to Benchmark and Rebuild Cost Models

December data confirms that underlying rate conditions remain favorable for shippers despite short-term weather-driven volatility. Spot rates are expected to ease again as winter disruptions fade, and contract pricing remains anchored. Rate stability continues to favor shippers—but the cycle is quietly setting up for a turn.

This is the right time to:

- Reassess cost-to-serve by lane and mode using updated tariff and fuel assumptions

- Rebalance modal strategies while intermodal and truckload rates remain compressed

- Rebuild routing guides and backup coverage during a high-capacity window

Underlying tightening signals are becoming more pronounced:

- Class 8 builds remain well below early-2025 levels as OEM discipline persists

- Retail Class 8 sales continue to run below replacement levels

- Orderboards for 2026 are still described by OEMs as “subpar”

- Trailer backlogs remain near rock-bottom levels despite sporadic order activity

When freight demand stabilizes—most likely in mid-to-late 2026—today’s underbuilding increases the risk of a rapid tightening cycle.

Shippers who lock in capacity, secure multi-year or annualized commitments, and deepen carrier partnerships now will outperform when the market turns.

Track Equipment Signals to Stay Ahead of Service Risk

Fleet age continues to rise as carriers defer replacement and OEMs maintain restrained output. ACT’s December reports indicate:

Used truck values continue to drift lower, reflecting lingering oversupply

Auction and wholesale pricing remain under pressure despite capacity contraction

Tractor inventories are nearing healthier levels, while vocational inventories remain elevated

New equipment costs are structurally higher due to embedded §232 tariff impacts

As fleets extend maintenance cycles and operate aging equipment, service reliability risks increase—particularly in reefer, tanker, and specialized segments where compliance and uptime are critical.

Shippers should use this window to audit:

- Carrier fleet age and maintenance strategies

- Emissions compliance readiness for late-2026 and 2027 (if needed)

- Financial resilience amid prolonged margin pressure

Prioritizing carriers with newer assets, stronger balance sheets, and clear compliance plans will reduce service disruptions and protect network performance through 2026–2027.

Plan for Policy-Led Volatility in 2026

EPA 2027 remains the largest policy-driven risk for shippers, though clarity has improved modestly. Late-2025 indications suggest emissions technology requirements will remain while warranty extensions are likely removed—confirming higher equipment costs beginning in 2027.

This evolving clarity has suppressed prebuy activity and delayed new equipment investment. Once timelines and pricing are fully confirmed—potentially in 2026—the market response could be abrupt:

- A compressed prebuy window could emerge

- OEM orderboards could tighten rapidly

- Lead times for tractors, trailers, and key components could extend

- Regional regulatory differences could create uneven service availability

For shippers, the playbook remains preparation—not prediction.

Actions to take now:

- Scorecard carriers on compliance readiness and fleet modernization plans

- Build modal flexibility into core networks

- Add carrier redundancy in high-risk or regulation-sensitive regions

- Revisit contract structures to include contingency pricing or multi-carrier allocation

These steps will help protect service continuity and prevent cost escalation as regulatory and tariff pressures converge in 2026.

In uncertain markets, chaos rewards preparation.

Want to hear more from ACT Research? Tim Denoyer sat down with Jeremy Wolfe from FleetOwner to talk about for-hire trucking's overcapacity problem and its likely solutions.

For-hire trucking's overcapacity problem—and its eventual solution (4:36 minute watch)

Your Questions, Answered.

Our forecasts aren't guesswork. They're built on ACT Research’s Class 8 supply modeling – a methodology with over 35 years of unparalleled historical accuracy. It's the industry benchmark for predicting capacity and rates.

Absolutely. Click here to get your exclusive Sample Insights Preview. See the depth and format of our reports.

The freight rate and volume forecasts are updated monthly on or near the 13th of the month (depending on if the 13th falls on a weekend). Due to our partnership with Cass Information Systems, we publish the latest forecast immediately after Cass publishes the Cass Index Report. This ensures that the latest Cass data is available first to Cass customers before our forecast of the Cass data is made available.

Our current forecast provides detailed insights through 2027. This three-year outlook allows you to plan both near-term strategies and longer-term decisions with confidence, using data-driven analysis of market trends and industry dynamics.

Don’t React. Predict. Profit.

The future of freight is unfolding. Will you be prepared, or will you be left behind? Your competitors are already seeking an edge. Secure your strategic advantage with Freight Forecast: Rate & Volume Outlook and transform uncertainty into unwavering confidence.