According to this month’s issue of ACT Research’s State of the Industry: U.S. Trailers report, with one month of data to collect before the book on 2025 is officially closed, it is fair to say that the year was less than stellar.

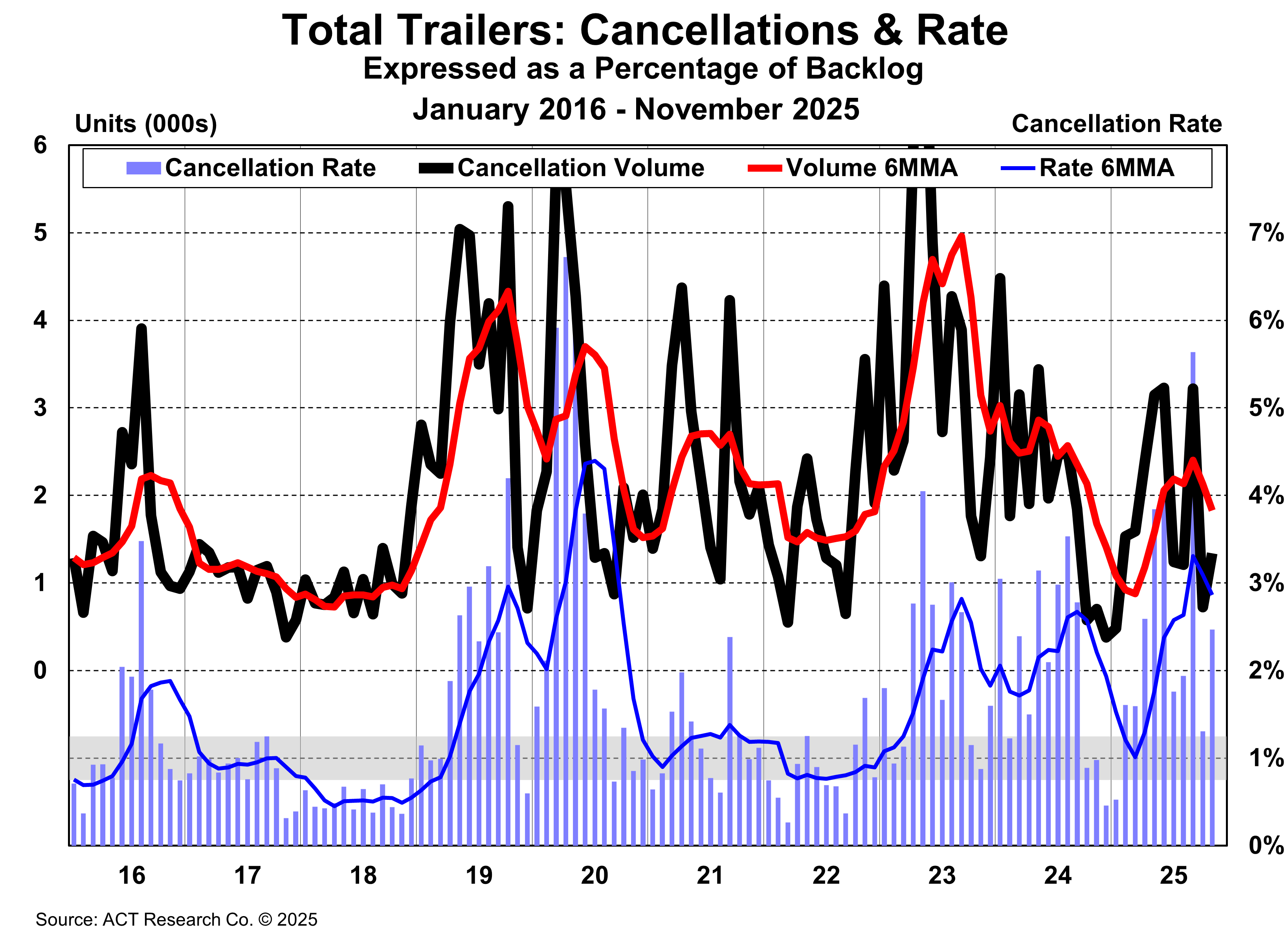

“November’s cancellation rate, as a percentage of backlog, was 2.5%, with data continuing to show elevated cancellations in dry van and tank segments,” said Jennifer McNealy, Director–CV Market Research & Publications at ACT Research. She added, “The largest level of cancels came from the tank segments, attributed to a decline in oil/gas activity, in general.”

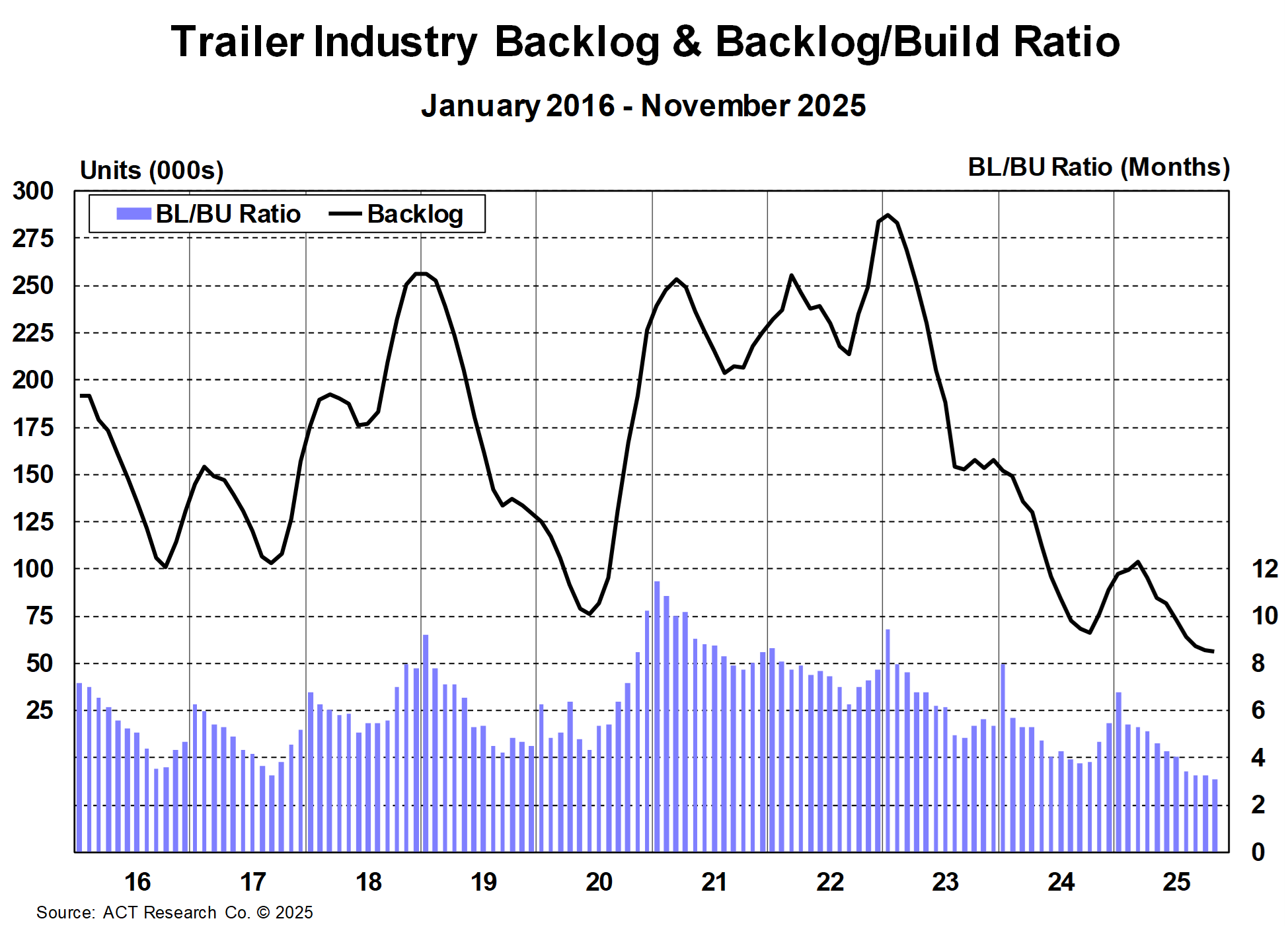

“Despite having moved to the historical start of the order season, build again outpaced orders in November. Trailer production was 1,800 units above orders, with backlogs contracting 2% sequentially and 24% compared to the same period in 2024,” McNealy continued. “Backlogs and build levels, with five fewer production days in November, conspired to carve a little more off the BL/BU ratio. After two consecutive 3.3-month readings, the BL/BU slipped to 3.1 months in November, which still commits the industry into mid-Q1’26 albeit at a somewhat anemic level,” she noted.

McNealy concluded, “US trailer constituents’ concerns remain high entering 2026, given the already low BL/BU already on the books, soft demand fundamentals, the impact of tariffs, higher input costs, weak carrier profit margins, as well as consumers’ financial health and their willingness to spend. Looking beyond the trough, we continue to hear anxiousness about whether or not the industry will be prepared for a possible sharp increase in demand once tariffs and trade stabilize, particularly given the rising replacement demand from an aging fleet.”

State of the Industry: U.S. Trailers Report Overview

ACT Research’s State of the Industry: U.S. Trailers report provides a monthly review of the current US trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments. It is accompanied by a database that gives historical information from 1996 to the present, as well as a ready-to-use graph packet, to allow organizations in the trailer production supply chain, and those following the investment value of trailers, trailer OEMs, and suppliers to better understand the market.

ACT Research Overview

ACT Research is recognized as the leading publisher of commercial vehicle truck, trailer, and bus industry data, market analysis, and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies. ACT Research is a contributor to the Blue Chip Economic Indicators and a member of the Wall Street Journal Economic Forecast Panel. ACT Research executives have received peer recognition, including election to the Board of Directors of the National Association for Business Economics, appointment as Consulting Economist to the National Private Truck Council, and the Lawrence R. Klein Award for Blue Chip Economic Indicators’ Most Accurate Economic Forecast over a four-year period. ACT Research senior staff members have earned accolades including Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast, Wall Street Journal Top Economic Outlook, and USA Today Top 10 Economic Forecasters. More information can be found at www.actresearch.net.

Additional Resources

Preliminary net trailer orders in November were 4,100 units lower than October’s 17,100 level, a 24% month-to-month decrease. At 13,000 units booked in November, order intake was 37% below last November’s level. Seasonal adjustment (SA) at this point in the annual order cycle lowers the monthly tally to about 10,500 units. Final November results will be available later this month. This preliminary market estimate is typically within ±5% of the final order tally.

“Sequentially, a slight dip in net orders is expected, as October is usually the strongest order intake month of the annual cycle, with orderboards for the next year beginning to open,” said Jennifer McNealy, Director CV Market Research & Publications at ACT Research. “November’s tally brings the year-to-date net order total to 151.3k units, or 9% more net orders than were accepted through year-to-date November 2024.”

McNealy added, “Not only do net orders continue to underwhelm, cancellations remain elevated. Looking forward, concerns about moderating economic activity, ongoing weak for-hire carrier profitability, and ambiguous government policies remain as challenges to stronger trailer demand. While pent-up demand is building, and fleets will eventually need to divert capex to trailing equipment purchases deferred over the past few years, stronger revenues will be needed before the purchase spigot is opened wider.”

- Cancellation rate: 2.5%

- Backlog-to-build ratio: 3.1 months

Click here to learn more information about ACT's State of the Industry: U.S. Trailers.

ACT Research is featured regularly by major news outlets for our work covering Class 8 truck orders, sales, forecasting, used truck sales, freight rates, trailer sales, and much more. Get more trends, HERE.

Save time with ACT Research’s media kit. Access ACT Research’s analyst bio, logos, press releases, video library, and more at your convenience. Our analysts are committed to delivering the most accurate data and forecasts. Looking for a speaker? Each analyst is available to speak at your conference or event. Access Media Kit Here.