According to the latest State of the Industry: U.S. Classes 3-8 Used Trucks by ACT Research, same dealer used Class 8 retail truck sales returned to sequential growth in December. The 12% m/m increase was directionally consistent with, but a little stronger than, the 9% seasonal gain.

“December is usually the fifth strongest sales month of the year, running almost exactly at average,” said Steve Tam, Vice President at ACT Research. He continued, “The auction and wholesale markets were mixed in December. Auction volumes surged 33% m/m in typical quarter end fashion. Dealers saw activity slow 15% m/m. Combined, total market same dealer sales volumes were 16% better m/m in December.”

“The Class 8 average retail sale price added 6.1% m/m in December, climbing to $57,048. Longer term, prices declined 0.5% y/y,” Tam explained.

State of the Industry: U.S. Classes 3-8 Used Trucks Report Overview

ACT’s Classes 3-8 Used Truck report provides data on the average selling price, miles, and age based on a sample of industry data. In addition, the report provides the average selling price for top-selling Class 8 models for each of the major truck OEMs – Freightliner (Daimler); Kenworth and Peterbilt (Paccar); International (Navistar); and Volvo and Mack (Volvo). This report is utilized by those throughout the industry, including commercial vehicle dealers to gain a better understanding of the used truck market, especially as it relates to changes in near-term performance.

ACT Research Overview

ACT Research is recognized as the leading publisher of commercial vehicle truck, trailer, and bus industry data, market analysis and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies. ACT Research is a contributor to the Blue Chip Economic Indicators and a member of the Wall Street Journal Economic Forecast Panel. ACT Research executives have received peer recognition, including election to the Board of Directors of the National Association for Business Economics, appointment as Consulting Economist to the National Private Truck Council, and the Lawrence R. Klein Award for Blue Chip Economic Indicators’ Most Accurate Economic Forecast over a four-year period. ACT Research senior staff members have earned accolades including Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast, Wall Street Journal Top Economic Outlook, and USA Today Top 10 Economic Forecasters. More information can be found at www.actresearch.net.

Additional Resources

Preliminary Class 8 same dealer used truck retail sales resurged 12% m/m in December, according to the latest preliminary release of the State of the Industry: U.S. Classes 3-8 Used Trucks published by ACT Research.

“The gain was better than expected based on historical seasonality, which called for a 9% m/m increase. Auction sales saw an even bigger jump, expanding 50% above November. Wholesale activity extended decline to a second month in December, shrinking 7% m/m,” according to Steve Tam, Vice President at ACT Research. “Total reported December preliminary sales came in 22% above November.”

“The preliminary average retail price (same dealer sales) of used Class 8 trucks rose m/m for the first time in five months in December, advancing 8.0% m/m to $57,135. December pricing lagged seasonal expectations, which called for a 10% increase,” Tam concluded.

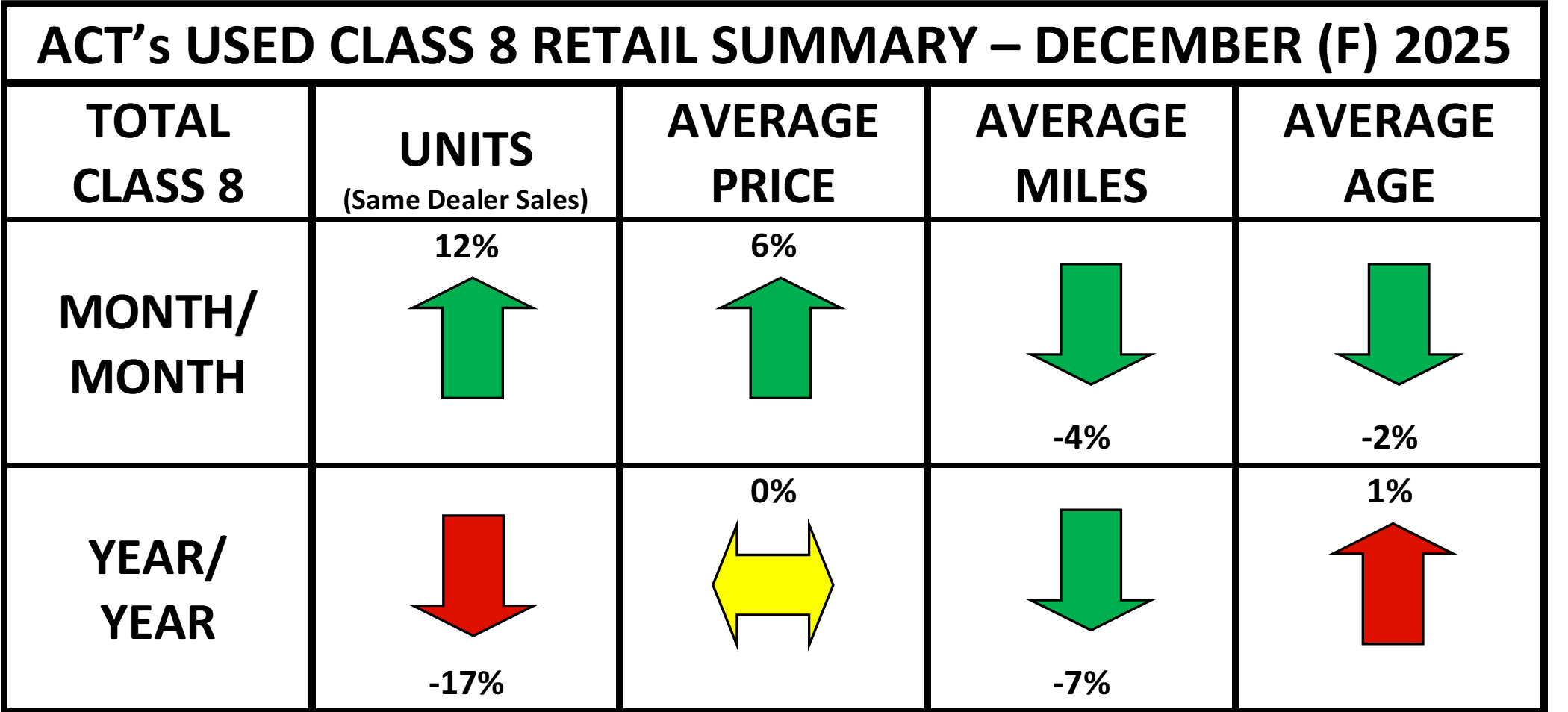

Compared to November 2025:

- Average retail volumes increased 12%.

- Retail price increased 6%.

- Miles declined 4%.

- Age declined 2%.

Compared to December 2024:

- Average retail volumes decreased 17%.

- Price was flat.

- Miles declined 7%.

- Age increased 1%.

Click here to learn more information about ACT's most subscribed report.

ACT Research is featured regularly by major news outlets for our work covering Class 8 truck orders, sales, forecasting, used truck sales, freight rates, trailer sales, and much more. Get more trends, HERE.

Save time with ACT Research’s media kit. Access ACT Research’s analyst bio, logos, press releases, video library, and more at your convenience. Our analysts are committed to delivering the most accurate data and forecasts. Looking for a speaker? Each analyst is available to speak at your conference or event. Access Media Kit Here.