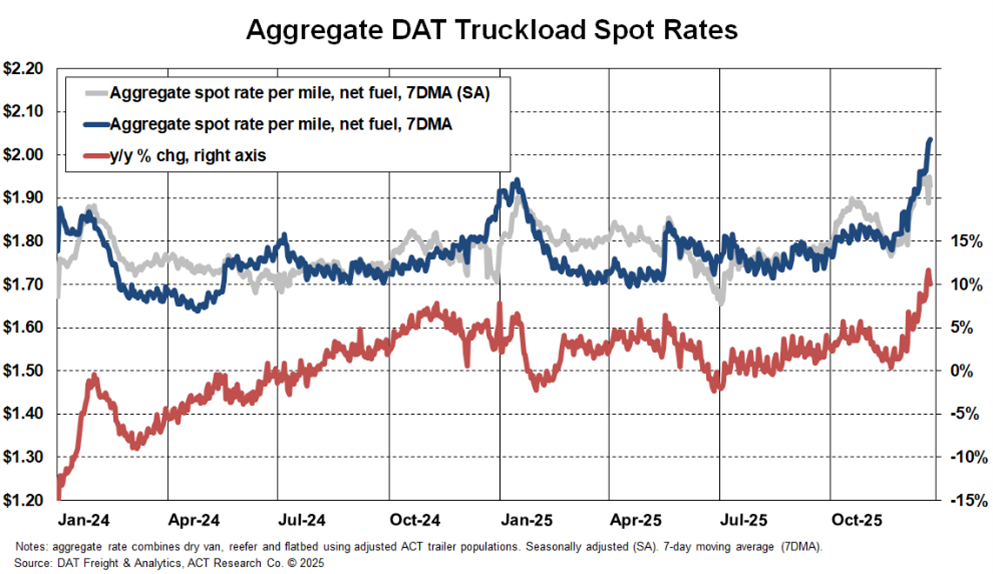

Frigid winter weather pinched spot capacity during one of the seasonally strongest periods of the year for demand, sending spot rates up in recent weeks, as discussed in the latest release of the Freight Forecast: Rate and Volume OUTLOOK report.

“After three winter storms in the first half of December, TL spot rates are 10% above year-ago levels in late-December, rising about 8% in seasonally adjusted terms over the past month.” said Tim Denoyer, ACT Research’s Vice President and Senior Analyst. “The combination of severe weather and solid holiday freight demand tells us the surge is temporary. Weather will warm and consumption will fall again after the holidays.

“However, these past few weeks have done more to swing the pendulum of pricing from shippers back toward fleets than anything we’ve seen in a few years. As the capacity contraction accelerates, this swing will continue in 2026.

“On the other hand, news from the EPA via the ATA in November informed the industry that EPA’27 low-NOx regulations will partially go into effect in 2027. Official word from the EPA is still a few months away, but this provides new motivation to prebuy in 2026.

“A large prebuy isn’t likely, since fleets are still managing down excess capacity from overbuying in 2023-2024, and investment dollars are scarce amid generationally low for-hire truckload profit margins. But Class 8 orders tend to move with spot rates, regardless of the sustainability of the trend, and this dynamic provides a degree of moderation for the 2026 rate outlook,” Denoyer concluded.

Freight Forecast Report Overview

The monthly 58-page ACT freight forecast provides analysis and forecasts for a broad range of U.S. freight measures, including the Cass Freight Index, Cass Truckload Linehaul Index, and DAT spot and contract rates by trailer type. The service provides monthly, quarterly, and annual predictions for the TL, LTL, and intermodal markets over a two- to three-year time horizon, including capacity, volumes, and rates. The Freight Forecast provides unmatched detail on the freight rate outlook, helping companies across the supply chain plan with greater visibility and less uncertainty.

ACT Research Overview

ACT Research is recognized as the leading publisher of commercial vehicle truck, trailer, and bus industry data, market analysis and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies. ACT Research is a contributor to the Blue Chip Economic Indicators and a member of the Wall Street Journal Economic Forecast Panel. ACT Research executives have received peer recognition, including election to the Board of Directors of the National Association for Business Economics, appointment as Consulting Economist to the National Private Truck Council, and the Lawrence R. Klein Award for Blue Chip Economic Indicators’ Most Accurate Economic Forecast over a four-year period. ACT Research senior staff members have earned accolades including Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast, Wall Street Journal Top Economic Outlook, and USA Today Top 10 Economic Forecasters. More information can be found at www.actresearch.net.

Additional Resources

Fleets continue to struggle financially, and with losses continuing to pile up, investments are being sharply curtailed, as discussed in the latest release of the Freight Forecast: Rate and Volume OUTLOOK report.

“TL fleet margins are at historic lows and unable to find traction, so the dollars aren’t there for equipment investment, particularly as tariffs push costs up,” said Tim Denoyer, ACT Research’s Vice President and Senior Analyst. “Our ACT Research commercial vehicle outlook foresees considerable declines in equipment demand in 2026, with rates insufficient to offset cost inflation.”

“Demand remains choppy, but highway tractor capacity is contracting at a quickening pace, with ongoing closures in the for-hire market, the reversal of private fleet expansion, and elevated driver enforcement. The issue for the freight cycle is now the affordability reductions tariffs are imposing on US businesses and consumers. Many of these taxes could be reversed if the Supreme Court upholds rulings that the IEEPA tariffs are unconstitutional, which seems more likely after oral arguments,” Denoyer concluded.

Click here to learn more information about ACT's most subscribed report.

ACT Research is featured regularly by major news outlets for our work covering Class 8 truck orders, sales, forecasting, used truck sales, freight rates, trailer sales, and much more. Get more trends, HERE.