According to this month’s issue of ACT Research’s State of the Industry: U.S. Trailers report, with the arrival of December data, 2025 is officially in the record books, and while victory in the sense of “we survived 2025” can be claimed, good news remains elusive.

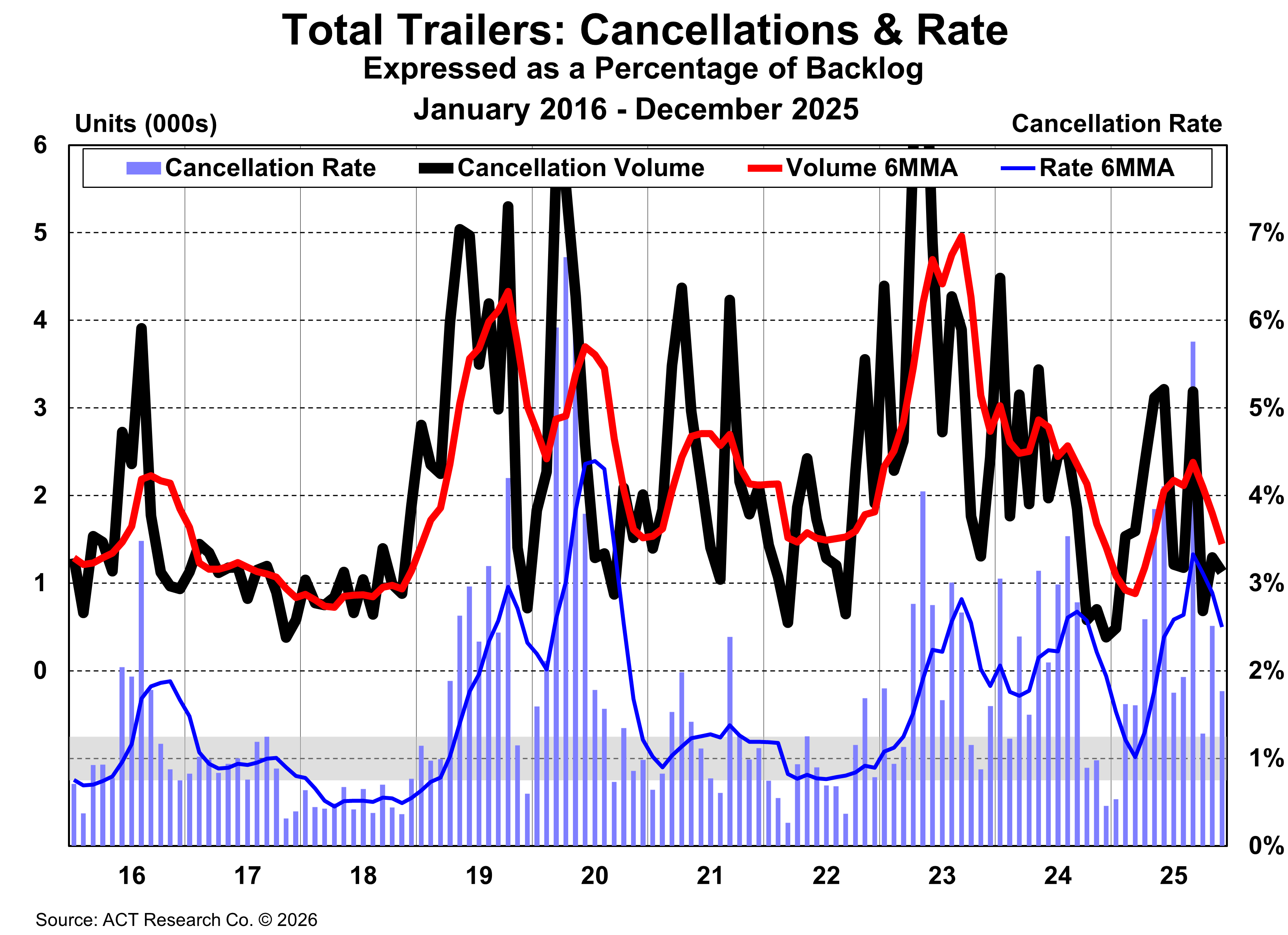

“December’s cancellation rate, as a percentage of backlog, remained high at a more subdued 1.8% versus November’s 2.5% rate. Data continued to show elevated cancellations in the van and tank segments,” said Jennifer McNealy, Director–CV Market Research & Publications at ACT Research. She added, “The highest cancellation rates came from the tank segments, attributed to a decline in oil/gas activity.”

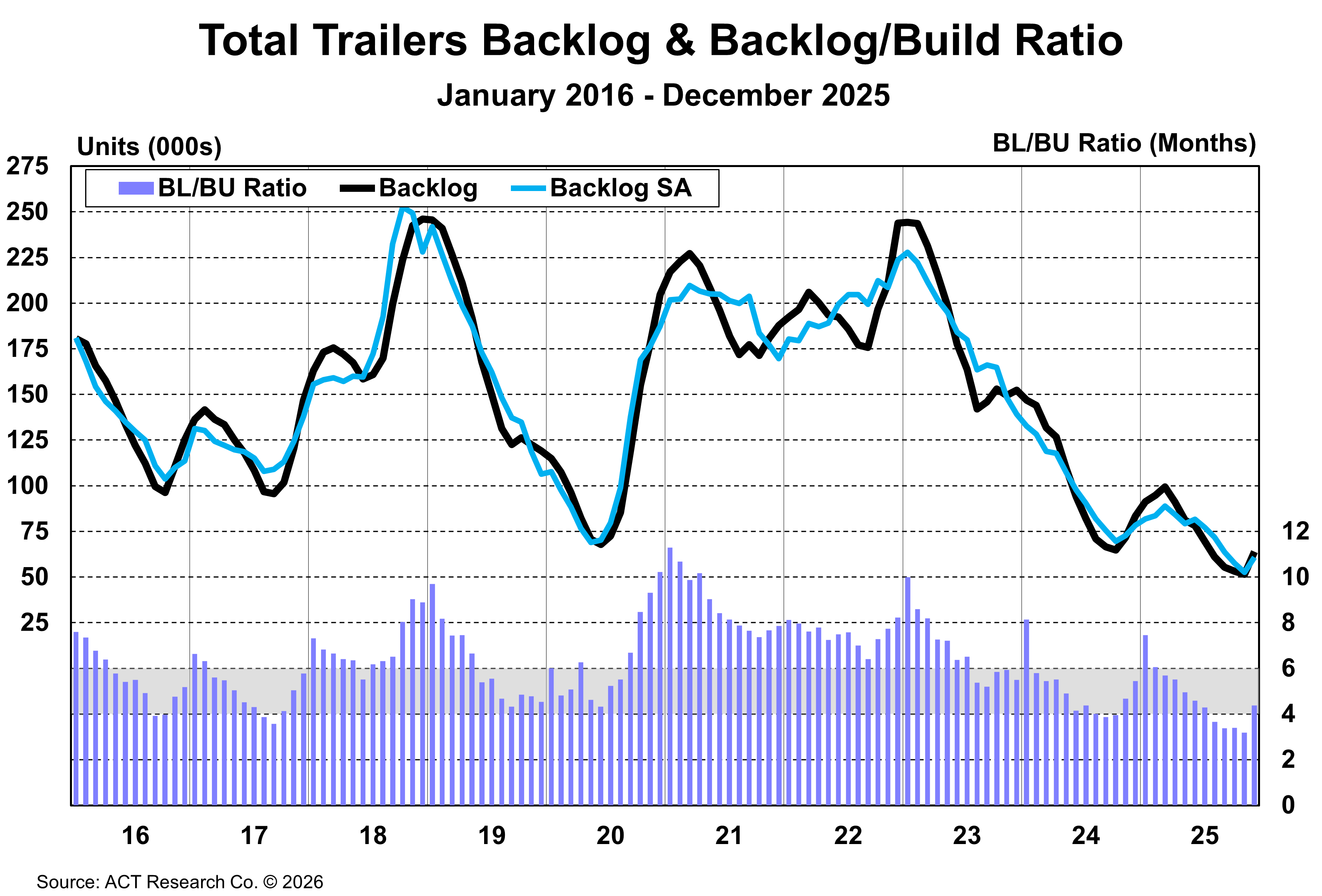

“Bigger backlogs and a lower December build rate conspired to push the backlog-to-build ratio higher for the first time in 2025,” McNealy continued. “Backlogs started the year at 7.5 months and trended lower from there. December’s 4.4-month ratio commits the industry into Q2’26.”

McNealy concluded, “End-of-2025 challenges continue as the trailer industry enters the new year, and opportunities in early 2026 remain thin. Positively, freight rates are now rising and the need to replace aging equipment continues to build. Pent-up replacements are expected to improve demand later this year.”

State of the Industry: U.S. Trailers Report Overview

ACT Research’s State of the Industry: U.S. Trailers report provides a monthly review of the current US trailer market statistics, as well as trailer OEM build plans and market indicators divided by all major trailer types, including backlogs, build, inventory, new orders, cancellations, net orders, and factory shipments. It is accompanied by a database that gives historical information from 1996 to the present, as well as a ready-to-use graph packet, to allow organizations in the trailer production supply chain, and those following the investment value of trailers, trailer OEMs, and suppliers to better understand the market.

ACT Research Overview

ACT Research is recognized as the leading publisher of commercial vehicle truck, trailer, and bus industry data, market analysis, and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies. ACT Research is a contributor to the Blue Chip Economic Indicators and a member of the Wall Street Journal Economic Forecast Panel. ACT Research executives have received peer recognition, including election to the Board of Directors of the National Association for Business Economics, appointment as Consulting Economist to the National Private Truck Council, and the Lawrence R. Klein Award for Blue Chip Economic Indicators’ Most Accurate Economic Forecast over a four-year period. ACT Research senior staff members have earned accolades including Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast, Wall Street Journal Top Economic Outlook, and USA Today Top 10 Economic Forecasters. More information can be found at www.actresearch.net.

Additional Resources

Preliminary net trailer orders in December were up nearly 13,400 units from November’s 11,900-unit level, a 112% month-to-month increase. At 25,300 units booked in December, order intake was almost 5% above December 2024’s level. Seasonal adjustment (SA) at this point in the annual order cycle lowers the monthly tally to 18,600 units. Final December trailer industry data will be available later this month. This preliminary order estimate is typically within ±5% of the final order tally.

“Sequentially, a slight uptick in net orders was expected, as December is usually the second strongest order month of the annual cycle,” said Jennifer McNealy, Director CV Market Research & Publications at ACT Research. “That said, preliminary data showed new vehicle demand for power units jolt awake in December, and those same factors of a firmer economic foundation, December’s weather-induced spike in freight rates, increasingly aged fleets, and some level of tariff-related clarity are also in play for trailing equipment demand.”

McNealy concluded, “December’s tally brings the Q4 net order total to 53.4k units and closes 2025 with 172.1k units of trailing equipment ordered, about 6% more trailers than were requested in 2024. While a better year than 2024, concerns about the level of economic activity that drives transportation demand, still-weak, although improving, for-hire carrier profitability, and uncertainty about future government policies remain as challenges to stronger trailer demand in the near term.”

- Cancellation Rate as a % of Backlog: 1.8%

- Backlogs: 4.4 months, commits the industry into Q2'26

Click here to learn more information about ACT's State of the Industry: U.S. Trailers.

ACT Research is featured regularly by major news outlets for our work covering Class 8 truck orders, sales, forecasting, used truck sales, freight rates, trailer sales, and much more. Get more trends, HERE.

Save time with ACT Research’s media kit. Access ACT Research’s analyst bio, logos, press releases, video library, and more at your convenience. Our analysts are committed to delivering the most accurate data and forecasts. Looking for a speaker? Each analyst is available to speak at your conference or event. Access Media Kit Here.