Booming economic activity results in more freight needing hauled. Freight volume refers to the amount of goods, import and export, moving through the transportation industry. Almost every physical product made or sold in the U.S. economy moves through the commercial vehicle (CV) market.

Why Is Freight Volume Important?

No matter the economic environment, having an understanding of market trends is extremely valuable for companies to be able to respond to challenges and opportunities.

Shippers own or supply the goods (freight) that carriers will transport, and brokers act as the middle man between them; thus, the amount of freight moving among these players will impact how they conduct their business. Businesses benefit from having accurate information related to freight volume so they can better plan for the road ahead.

An effective way to think about supply and demand in the truckload (TL) market is the concept of a pendulum. When demand grows faster than capacity and the supply of drivers or tractors is short, the pendulum swings to the fleets and freight rates rise. When supply growth outpaces demand growth, the pendulum swings to the shipper and freight rates fall. Trying to match long-term businesses with short-term fluctuations in freight demand is cyclical.

How is Freight Volume Measured?

For any company, the scope of internal data can be limiting and unfortunately, the cost of gathering broader market analysis can be prohibitive. As a solution, ACT Research gathers information on a confidential basis from a wide variety of TL carriers, especially the small and mid-size TL carriers that haul a major portion of freight in the North American market. The elements of information include:

- business volume trends,

- market price trends, and

- expectations for vehicle sales and purchases.

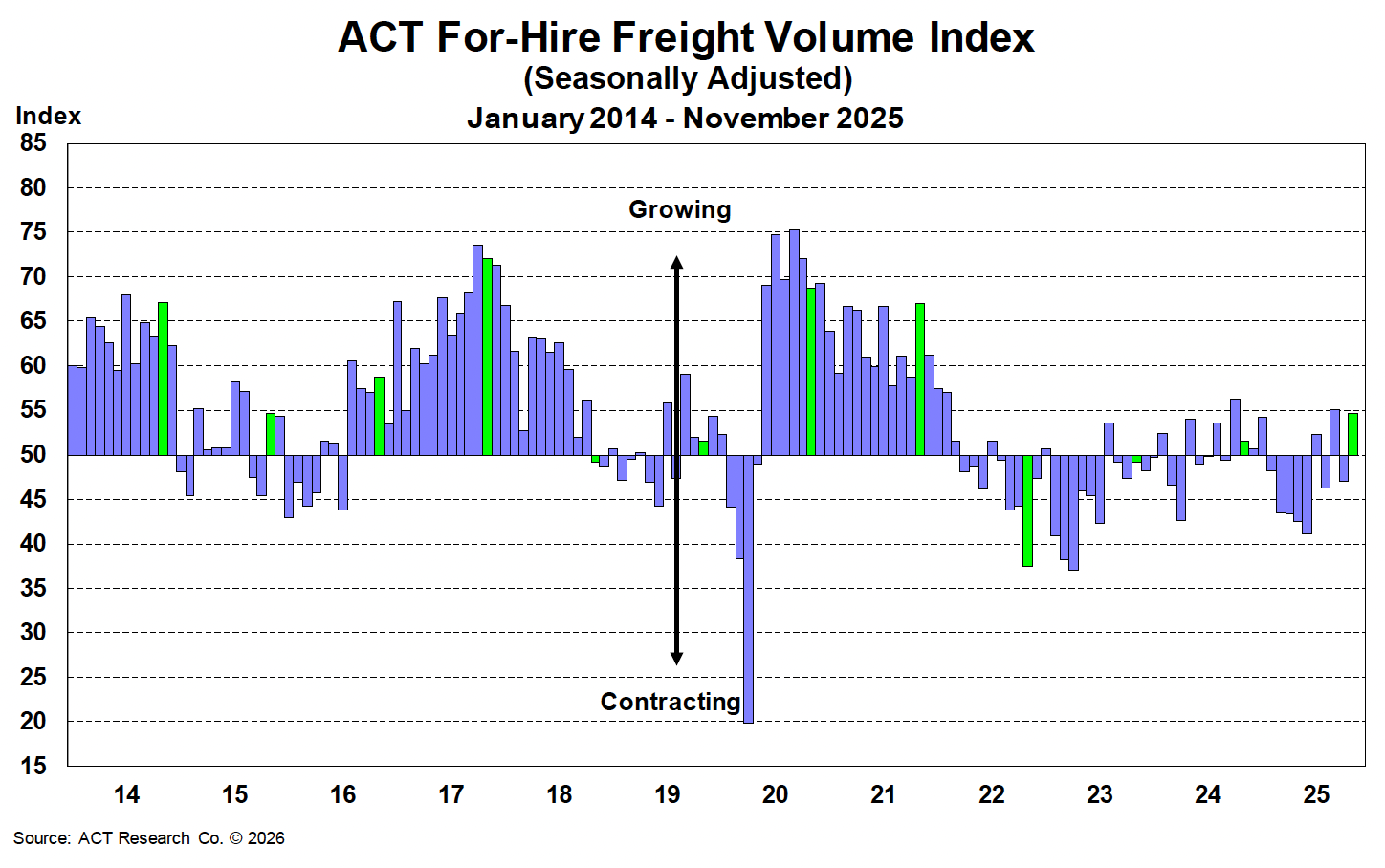

The ACT For-Hire Trucking Index surveys carriers to help paint a comprehensive picture of trends in transportation and CV markets.

Additionally, ACT Research partners with Cass Information Systems, Inc., the nation’s largest processor of freight billing, to gain insight on current market trends and the state of the shipping sector. ACT uses the Cass Freight Index®, which measures freight volumes and expenditures, and the Truckload Linehaul Index®, a pricing indicator, to forecast freight demand.

What is ACT saying right now about freight volume?

Updated Freight Volume Overview – January 2026

Freight volumes remain weak entering January 2026, with no clear evidence of a sustained rebound following the close of 2025. The temporary lift from pre-tariff shipping has fully unwound, and the market remains firmly in a payback-driven phase. According to the latest ACT Research data, for-hire freight volumes continue to track largely sideways, with activity showing little net improvement despite late-year volatility. While capacity contraction is accelerating beneath the surface, excess supply and uneven demand continue to cap volume recovery across most major freight segments.

Retail-oriented freight remains the primary drag on improvement. Consumer spending has moderated further entering the new year, pressured by high borrowing costs, lingering tariff-driven inflation, and increased household caution. Retailers continue to operate with lean inventories and conservative replenishment strategies, limiting freight tied to restocking. E-commerce volumes remain relatively resilient, but growth has slowed and remains insufficient to offset weakness in general merchandise, discretionary goods, and bulky durable categories.

Intermodal activity remains under pressure entering 2026. The unwind of pre-tariff import demand continues to flow through containerized volumes, keeping intermodal shipments down on a year-over-year basis. Rail service performance has improved and port congestion remains limited, but aggressive truckload pricing and ample highway capacity continue to restrict modal conversion. Intermodal spot rates remain compressed, weighing on margins and dampening near-term growth incentives.

Industrial-oriented freight continues to struggle. Manufacturing output remains soft, and factory orders show limited momentum, constraining freight tied to machinery, components, and industrial inputs. Construction activity remains bifurcated: public-sector infrastructure, utility, and data-center-related freight provides a modest floor, while private residential and commercial construction remains weak. Energy-related freight has softened further, influenced by cautious capital spending, policy uncertainty, and uneven drilling activity.

Looking into early 2026, risks remain skewed to the downside. ACT Research does not expect a traditional post-holiday demand rebound, noting that consumer demand remains selective and inventories are already positioned conservatively. Winter weather disruptions in late December and early January have created short-term volatility in freight flows, but these events have not altered the broader demand trajectory. Carriers continue to emphasize cost discipline, network optimization, and operational flexibility as they navigate ongoing volume softness.

With pre-tariff paybacks lingering, imports and industrial activity subdued, and freight-generating sectors lacking momentum, overall freight volumes are expected to remain stagnant into early 2026. ACT Research anticipates that any meaningful stabilization is more likely to emerge later in the year, supported by continued capacity contraction rather than a near-term demand-driven rebound.

Freight Volume Forecasting

When forecasting the truckload and less-than-truckload markets, ACT Research utilizes two primary metrics to measure industry volumes (demand):

In short, both measure consumer demand that drives the shipping of goods by a carrier. In other words, measurements of the volume of freight hauled.

Cass Freight Index®- Shipments measures the number of freight shipments hauled within North America by Cass Information Systems. Cass processes more than $44 billion in freight transactions annually and is the ideal source for measuring shipper volumes.

ACT Freight Composite Index is a measure of the estimated total freight hauled by sector as developed by ACT Research.

These two demand metrics provide insights into the expected volumes of freight shipped over the next 6-36 months, providing a supply-demand balance when utilized with ACT's capacity (supply) metrics.

To see how freight volume is likely to change in the future, and for detailed analysis and forecasts for truckload, less-than-truckload, and intermodal, see ACT's freight & transportation forecast.