With freight markets still flat, rates slipping, and fleet investment stalling, proactive procurement and policy awareness remain critical competitive differentiators.

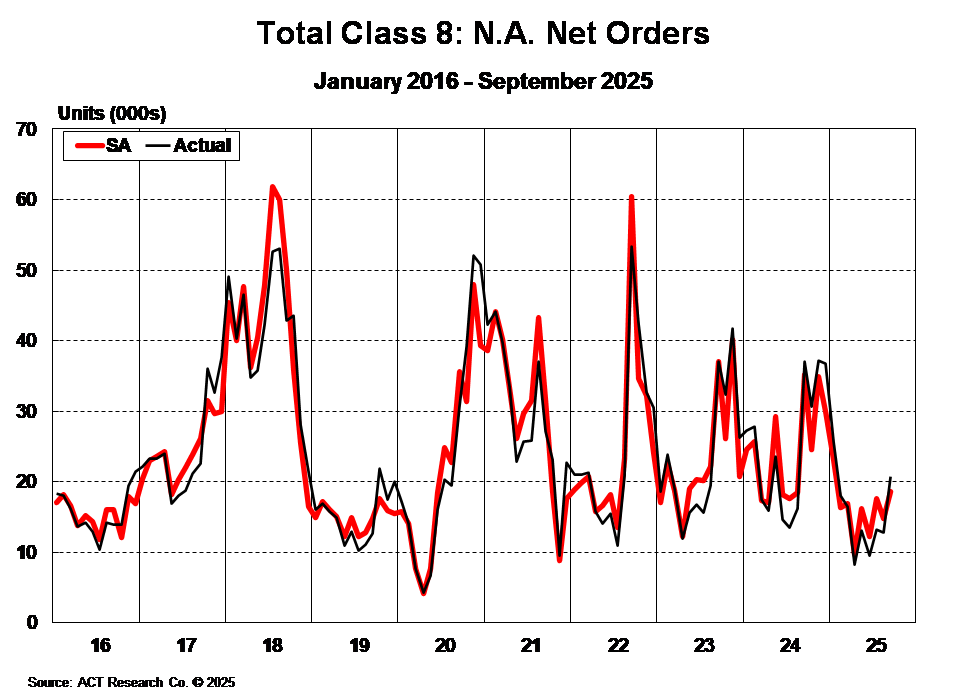

As of October 2025, the freight environment appears calm on the surface: spot rates have softened, contract pricing remains flat, and capacity remains abundant across most modes. But beneath the surface, structural signals are tightening. Class 8 orders were down y/y in September, OEM build rates continue to fall, and EPA 2027 rulemaking remains unresolved. Fleets are deferring investment; aging equipment is becoming a service risk, and regulatory uncertainty is setting up for capacity dislocation once demand normalizes.For shippers, this quiet period represents a strategic window—one that favors those preparing now. The market’s apparent stability is temporary; the shippers who benchmark, negotiate, and hedge early will control cost and capacity when disruption returns.

Use Current Rate Stability to Benchmark and Rebuild Cost Models

October data confirms that spot and contract rates remain near multi-year lows, with little sign of upward pressure. The balance of power remains squarely in shippers’ favor—but this phase should be viewed as an optimization window, not a comfort zone.

Now is the time to:

- Reassess cost-to-serve by lane, mode, and customer mix.

- Rebalance modal strategies to improve resilience and flexibility.

- Renegotiate routing guides while capacity remains loose.

However, signs of future imbalance are emerging. Class 8 build rates have fallen roughly one-quarter from early-year levels, and new orders remain well below replacement thresholds. Fleet reinvestment is stalled; OEM production slots remain open into Q1 2026. When freight volumes recover—or regulatory pressure triggers a prebuy—capacity will tighten rapidly.

Shippers who lock in rates and secure strategic capacity partnerships now will be best positioned when the cycle shifts.

Track Equipment Signals to Stay Ahead of Service Risk

Fleet equipment age continues to climb as investment lags. ACT data shows that replacement demand is not being met, and OEMs are managing through reduced build schedules and smaller orderboards.

Meanwhile:

- Class 8 equipment costs remain up 3–5% y/y due to tariffs and input inflation.

- Reefer and specialized trailers are facing higher compliance and material costs.

- Used truck values remain down ~30% y/y, signaling active de-fleeting and aging fleet profiles.

This gradual aging of assets introduces hidden service risk—including higher breakdown frequency, tighter maintenance cycles, and potential regional coverage gaps. Shippers should take advantage of this window to audit carrier health, fleet age, and emissions readiness, prioritizing partners with modern, well-maintained equipment and stronger balance sheets.

Plan for Policy-Led Volatility in 2026

The EPA 2027 emissions standards remain the industry’s largest unknown. While the compliance date stands, enforcement timing and final specifications are increasingly uncertain. Most fleets are operating under the assumption of a delay or partial rollback, leaving prebuy planning on hold.

Once regulatory clarity arrives—potentially in 2026—a compressed prebuy window could emerge, driving sudden demand spikes across OEMs, components, and financing. This will ripple into equipment availability, lead times, and service reliability, especially in regions with stricter emissions enforcement.

For shippers, this means preparation—not prediction:

- Scorecard carriers on fleet age and compliance readiness.

- Diversify modes to mitigate exposure to over-the-road bottlenecks.

- Build redundancy into high-service lanes and compliance-sensitive regions.

These actions will protect network performance and prevent cost escalation when policy shifts create volatility.

Want to hear more from ACT Research? Tim Denoyer sat down with Jeremy Wolfe from FleetOwner to talk about for-hire trucking's overcapacity problem and it's likely solutions.

For-hire trucking's overcapacity problem—and its eventual solution (4:36 minute watch)

Freight Forecast Report Overview

The monthly 58-page ACT freight forecast provides analysis and forecasts for a broad range of U.S. freight measures, including the Cass Freight Index, Cass Truckload Linehaul Index, and DAT spot and contract rates by trailer type. The service provides monthly, quarterly, and annual predictions for the TL, LTL, and intermodal markets over a two- to three-year time horizon, including capacity, volumes, and rates. The Freight Forecast provides unmatched detail on the freight rate outlook, helping companies across the supply chain plan with greater visibility and less uncertainty.

ACT Research Overview

ACT Research is recognized as the leading publisher of commercial vehicle truck, trailer, and bus industry data, market analysis and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies. ACT Research is a contributor to the Blue Chip Economic Indicators and a member of the Wall Street Journal Economic Forecast Panel. ACT Research executives have received peer recognition, including election to the Board of Directors of the National Association for Business Economics, appointment as Consulting Economist to the National Private Truck Council, and the Lawrence R. Klein Award for Blue Chip Economic Indicators’ Most Accurate Economic Forecast over a four-year period. ACT Research senior staff members have earned accolades including Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast, Wall Street Journal Top Economic Outlook, and USA Today Top 10 Economic Forecasters. More information can be found at www.actresearch.net.

Additional Resources

Frigid winter weather pinched spot capacity during one of the seasonally strongest periods of the year for demand, sending spot rates up in recent weeks, as discussed in the latest release of the Freight Forecast: Rate and Volume OUTLOOK report.

“After three winter storms in the first half of December, TL spot rates are 10% above year-ago levels in late-December, rising about 8% in seasonally adjusted terms over the past month.” said Tim Denoyer, ACT Research’s Vice President and Senior Analyst. “The combination of severe weather and solid holiday freight demand tells us the surge is temporary. Weather will warm and consumption will fall again after the holidays.

“However, these past few weeks have done more to swing the pendulum of pricing from shippers back toward fleets than anything we’ve seen in a few years. As the capacity contraction accelerates, this swing will continue in 2026.

“On the other hand, news from the EPA via the ATA in November informed the industry that EPA’27 low-NOx regulations will partially go into effect in 2027. Official word from the EPA is still a few months away, but this provides new motivation to prebuy in 2026.

“A large prebuy isn’t likely, since fleets are still managing down excess capacity from overbuying in 2023-2024, and investment dollars are scarce amid generationally low for-hire truckload profit margins. But Class 8 orders tend to move with spot rates, regardless of the sustainability of the trend, and this dynamic provides a degree of moderation for the 2026 rate outlook,” Denoyer concluded.

Click here to learn more information about ACT's most subscribed report.

ACT Research is featured regularly by major news outlets for our work covering Class 8 truck orders, sales, forecasting, used truck sales, freight rates, trailer sales, and much more. Get more trends, HERE.