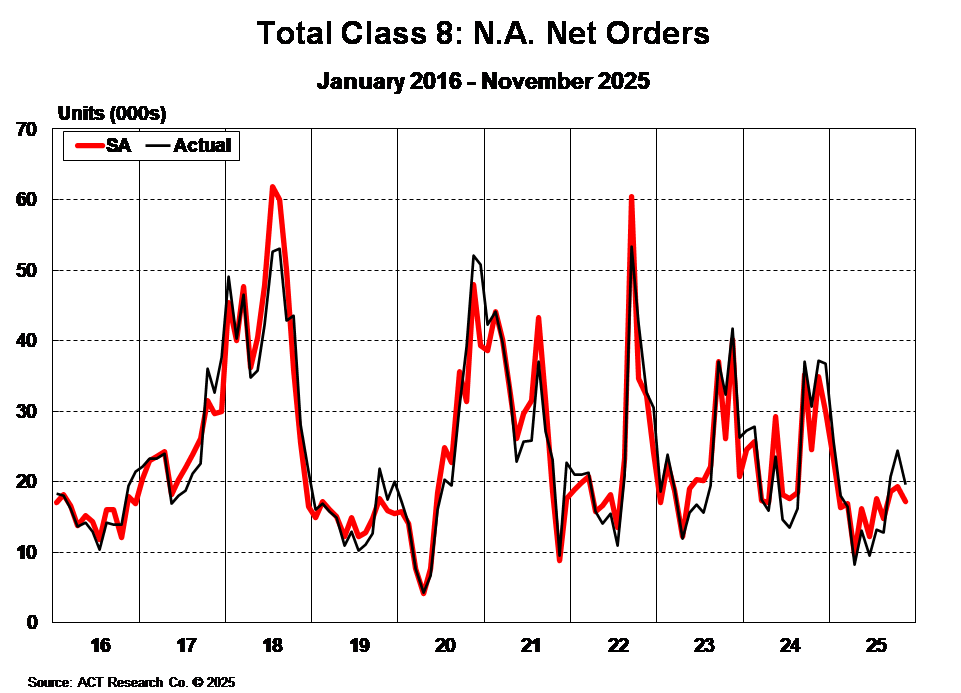

Final North American Class 8 net orders totaled 19,547 units in November, down 48% y/y, as published in ACT Research’s latest State of the Industry: NA Classes 5-8 report.

“While EPA’27 clarity is positive, ongoing lack of for-hire carrier profitability is the main bottleneck for improved new vehicle demand. While supply has started to come out of the market, demand is soft, with cyclical freight generating sectors lagging,” according to Carter Vieth, Research Analyst at ACT Research. “Reflecting current freight market headwinds, Class 8 tractor orders totaled 12,879 units, down 55% y/y.”

“Vocational Class 8 orders totaled 6,668 units, down 22% y/y,” he continued. “Vocational, like the tractor market, continues to be affected in the short to medium term by policy fluctuations. Though unlike the tractor market, tailwinds related to AI infrastructure and the necessary utility buildout, coupled with regulatory clarity around EPA’27, are likely to benefit vocational trucks in the short term, as planning for 2027 is now clearer.”

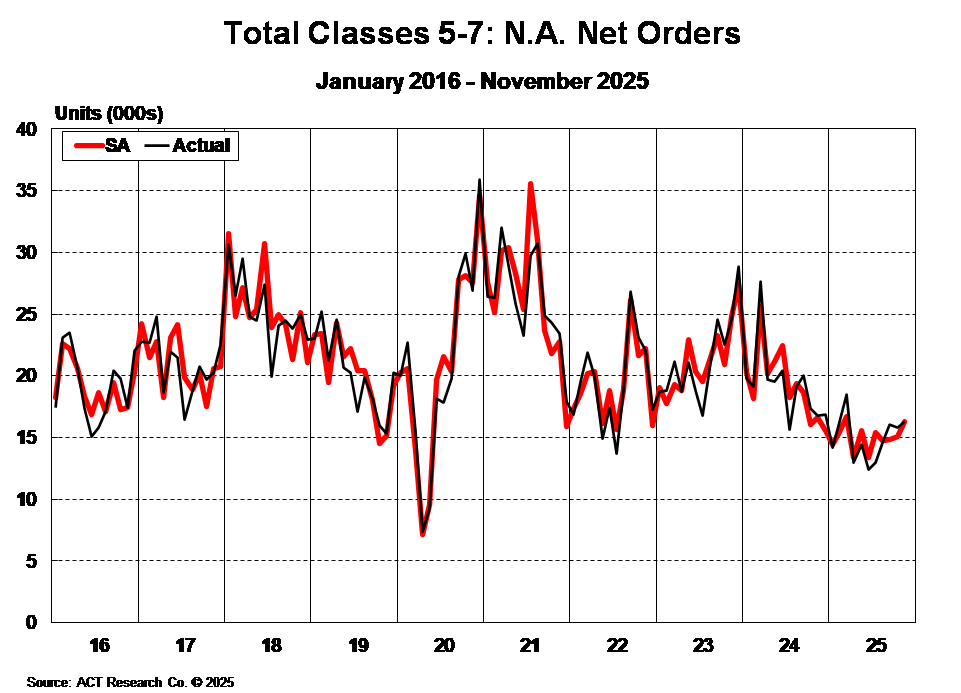

Regarding medium duty, Vieth added, “Total Classes 5-7 orders fell 3.1% y/y to 16,262 units. Being a largely services-oriented market, medium-duty demand has slowed this year on tariffs and slowing services growth. Consumer sentiment is now at levels typically reserved for recessions.”

State of the Industry: NA Classes 5-8 Report Overview

ACT’s State of the Industry: NA Classes 5-8 report provides a monthly look at the current production, sales, and general state of the on-road heavy and medium duty commercial vehicle markets in North America. It differentiates market indicators by Class 5, Classes 6-7 chassis and Class 8 trucks and tractors, detailing measures such as backlog, build, inventory, new orders, cancellations, net orders, and retail sales. Additionally, Class 5 and Classes 6-7 are segmented by trucks, buses, RVs, and step van configurations, while Class 8 is segmented by trucks and tractors with and without sleeper cabs. This report includes a six-month industry build plan, backlog timing analysis, historical data from 1996 to the present in spreadsheet format, and a ready-to-use graph package. A first-look at preliminary net orders is also published in conjunction with this report.

ACT Research Overview

ACT Research is recognized as the leading publisher of commercial vehicle truck, trailer, and bus industry data, market analysis and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies. ACT Research is a contributor to the Blue Chip Economic Indicators and a member of the Wall Street Journal Economic Forecast Panel. ACT Research executives have received peer recognition, including election to the Board of Directors of the National Association for Business Economics, appointment as Consulting Economist to the National Private Truck Council, and the Lawrence R. Klein Award for Blue Chip Economic Indicators’ Most Accurate Economic Forecast over a four-year period. ACT Research senior staff members have earned accolades including Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast, Wall Street Journal Top Economic Outlook, and USA Today Top 10 Economic Forecasters. More information can be found at www.actresearch.net.

Additional Resources

November preliminary North America Classes 5-8 net orders of 36k units declined 33% y/y. Complete industry data for November, including final order numbers, will be published by ACT Research in mid-December.

“Preliminary Class 8 orders totaled 19,700 units in November, down 47% y/y, in what is typically the year’s third strongest month for orders,” shared Carter Vieth, Research Analyst at ACT Research. “Despite last month’s announcement regarding EPA’27 adding much needed clarity for the market, the obvious bottleneck to stronger order activity is lack of carrier profitability. Spot rates continue to tread along the bottom, and while supply is coming out of the market, demand in key freight sectors is lagging.”

Regarding medium duty, he added, “Preliminary reporting shows November NA Classes 5-7 orders decreased 2.9% y/y to 16,300 units. Medium duty continues to be impacted by small businesses getting crushed by tariffs, uncertainty, and levels of consumer pessimism typically reserved for recessions.”

Class 8:

Net Orders: 19.5k, -48% y/y

Classes 5-7:

Net Orders: 16.3k, -3.1% y/y

Click here to learn more information about ACT's State of the Industry: NA Classes 5-8 Vehicles data.

ACT Research is featured regularly by major news outlets for our work covering Class 8 truck orders, sales, forecasting, used truck sales, freight rates, trailer sales, and much more. Get more trends, HERE.

Save time with ACT Research’s media kit. Access ACT Research’s analyst bio, logos, press releases, video library, and more at your convenience. Our analysts are committed to delivering the most accurate data and forecasts. Looking for a speaker? Each analyst is available to speak at your conference or event. Access Media Kit Here.