Freight Trucking Rates

Freight and Trucking Industry Overview - December 2025

Updated December 22, 2025

Freight & Trucking Rate Update

December 2025

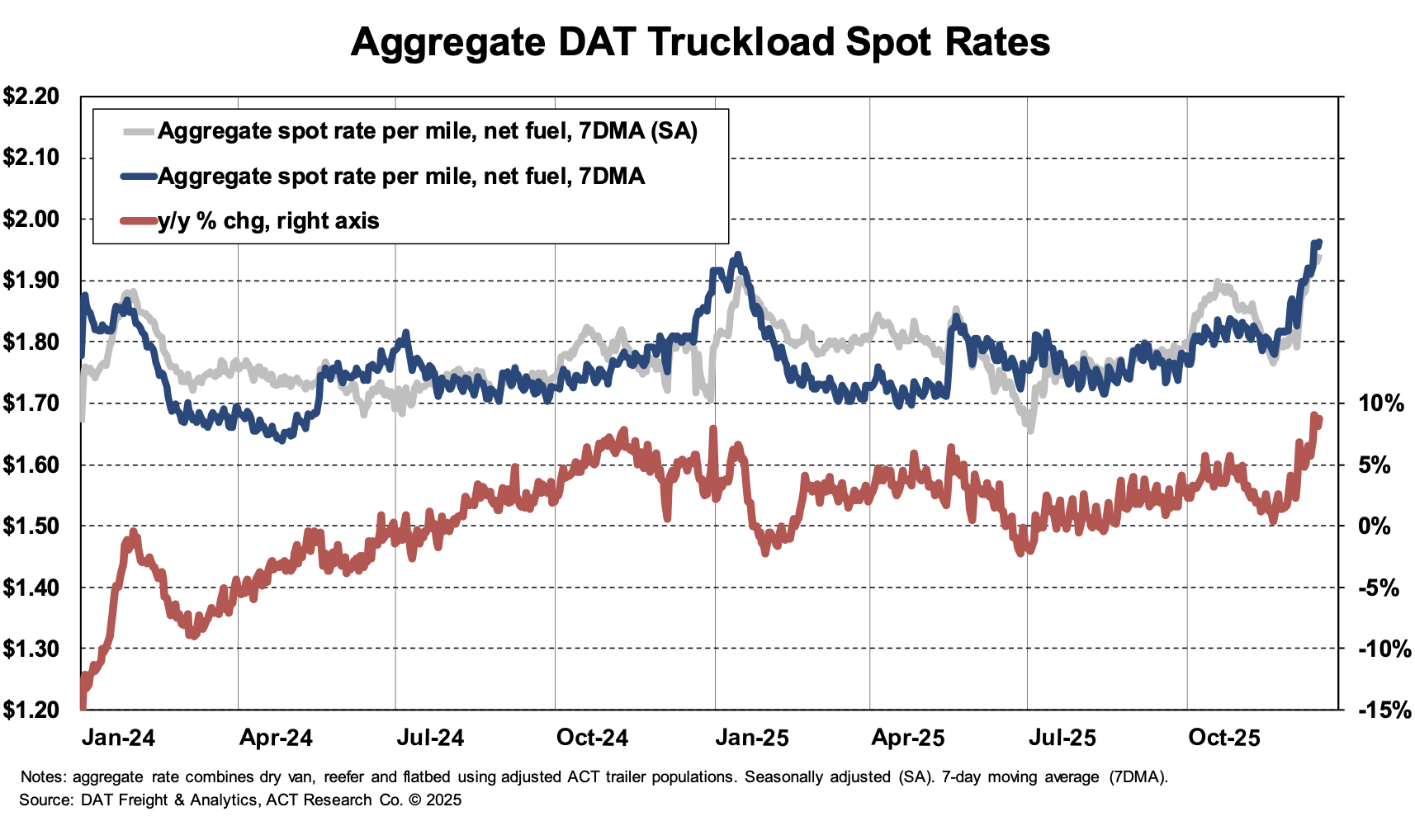

As of December 2025, the freight and trucking industry remains mired in a prolonged correction, though early signs of capacity tightening are beginning to surface beneath still-soft demand. Pre-tariff pull-forward activity has given way to payback effects, while winter weather disruptions briefly tightened capacity and lifted spot rates in early December. Despite these temporary dislocations, the broader market continues to face seasonally slowing volumes, uneven demand, and lingering tariff-related uncertainty.

Spot rates moved higher in early December as multiple winter storms disrupted networks across the Midwest and Upper Midwest, briefly stressing carrier availability during a tight seasonal window. However, ACT Research’s December Freight Forecast cautions that much of this rate strength is weather-driven and likely to fade as conditions normalize. Structural improvement in rates remains dependent on sustained fleet contraction and a gradual demand recovery, both of which are expected to play out over 2026 rather than immediately.

Below are the latest insights on dry van, flatbed, and reefer rates based on ACT Research’s December 2025 Freight Forecast.

Spot Market Trends

Dry Van

Dry van spot rates firmed sharply in early December as severe winter weather disrupted operations just as holiday demand peaked. Spot rates rose materially from mid-November levels, driven by elevated load rejections, tighter routing guides, and temporary capacity dislocations. While the move was meaningful, ACT expects much of this strength to unwind as weather moderates and post-holiday demand softens.

Despite the short-term spike, dry van rates remain well below historical seasonal norms, and a durable uptrend will require continued fleet contraction through 2026.

Flatbed

Flatbed spot rates held relatively steady into December, benefiting modestly from weather-related tightening but lacking fundamental demand support. Construction, manufacturing, and heavy industrial freight remain subdued, limiting upside. While infrastructure-related freight provides some stability, it has not been sufficient to materially tighten flatbed capacity.

Flatbed capacity remains ample, keeping rate ceilings capped despite intermittent weather disruptions.

Reefer

Reefer spot rates saw brief improvement in early December amid weather-related disruptions and seasonal food movement, but conditions remain broadly oversupplied. As holiday demand fades and seasonal produce volumes slow, equipment availability has increased again.

ACT continues to expect reefer pricing to soften after the holidays, with limited upside until late 2026 as excess capacity is gradually absorbed.

Contract Rates

Dry Van

Dry van contract rates remained largely unchanged in December. The spot/contract spread widened temporarily following the early-December spot rate spike, but contract negotiations continue to favor shippers. Early 2026 bid activity suggests only modest upward adjustments at best, reflecting ongoing caution tied to freight uncertainty.

Contract leverage remains primarily with shippers despite emerging signs of capacity tightening.

Flatbed

Flatbed contract rates remained soft in December and continue to lag year-ago levels. Weak industrial demand and subdued private construction activity continue to weigh on pricing. ACT does not expect meaningful contract rate acceleration until freight-generating sectors show clearer signs of recovery later in 2026.

Reefer

Reefer contract rates held steady in December. While refrigerated carriers face rising operating costs—including insurance, maintenance, and compliance—shippers continue to use soft volumes and ample capacity to hold rates flat. Sustained tightening in reefer capacity remains unlikely before mid-2026.

Summary

The freight market remains fragile and largely oversupplied, with December’s spot rate gains driven more by winter weather than by fundamental demand improvement. Contract rates remain flat, and while capacity contraction is accelerating beneath the surface, it has yet to translate into sustained pricing power.

Carriers continue to navigate rising input costs, tariff-driven equipment inflation, and uneven freight demand. Many fleets are extending trade cycles, limiting capital spending, and focusing on operational efficiency to preserve margins.

Absent a sustained improvement in freight volumes or a clearer resolution on tariff and regulatory policy, ACT Research expects the freight rate environment to remain defensive into 2026. A durable recovery is increasingly tied to ongoing capacity contraction and a gradual demand rebound rather than short-term disruptions.

To see how freight trucking rates change in the future, and for detailed analysis and forecasts, see ACT's freight & transportation forecast.

Though contract rates remain flat and spot rates are beginning to fade after a short-lived pre-tariff lift, persistently weak Class 8 orders and elevated inventories confirm that fleets remain firmly in replacement—not expansion—mode. With §232 tariffs driving up equipment costs and maintenance expenses, and for-hire carrier profitability still compressed, recovery now depends less on demand strength and more on gradual, structural capacity tightening. As legal and political uncertainty clouds the future of the EPA’s 2027 low-NOx rule, most fleets have paused aggressive prebuy activity and shifted 2026 equipment plans toward cost control, lifecycle extension, and operational flexibility rather than growth.

Tim Denoyer

VP & Sr. Analyst

Resources

Whether you’re new to our company or are already a subscriber, we encourage you to take advantage of all our resources.