Refrigerated Rates

Reefer Rates - January 2026

Updated: January 26, 2026

Reefer Truckload (TL) Sector

January 2026

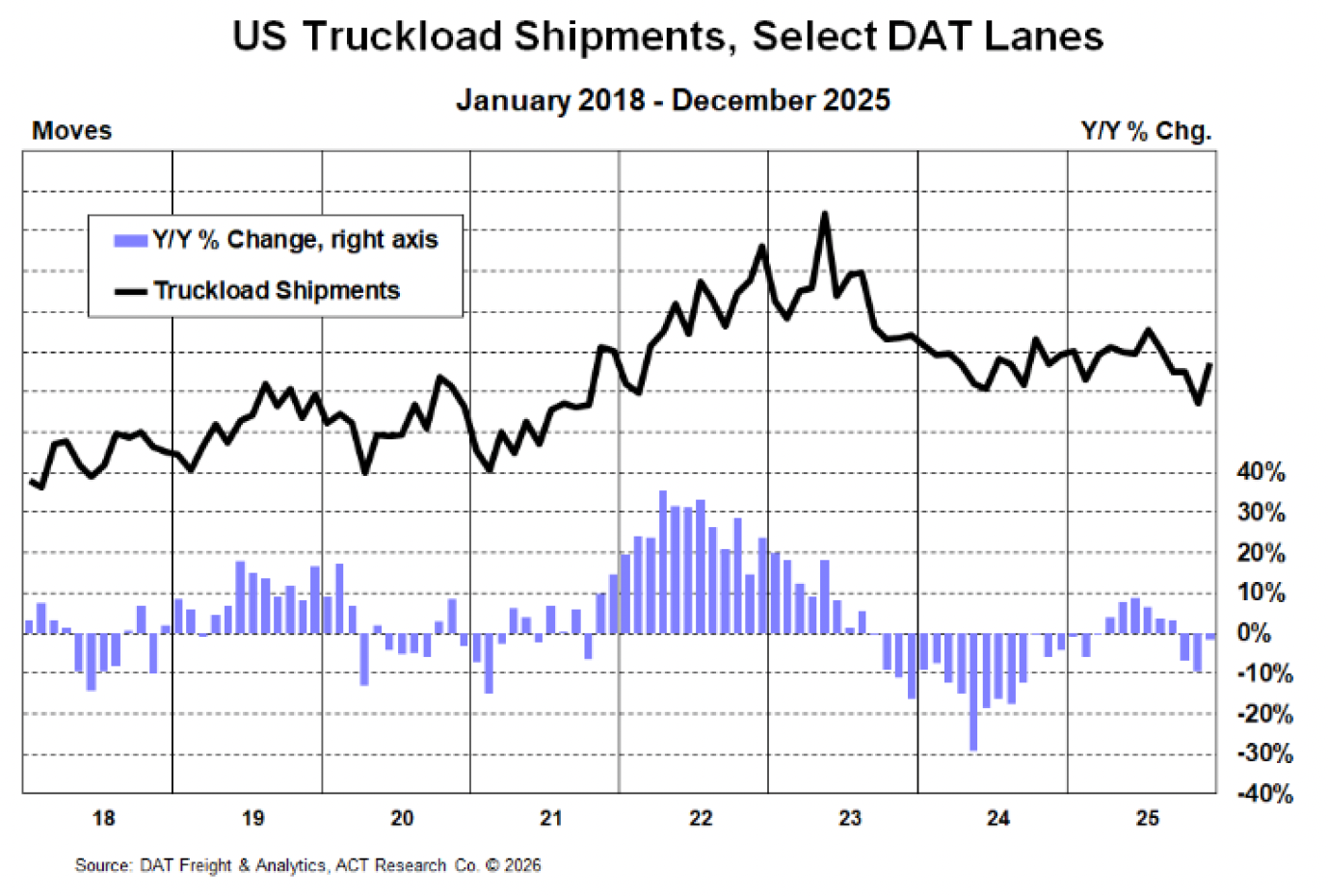

The reefer market entered January 2026 with improved rate momentum following a weather-disrupted close to 2025, though underlying demand fundamentals remain uneven. Core food and pharmaceutical freight continue to provide stability, but excess capacity persists as consumer spending moderates and discretionary refrigerated volumes remain soft. ACT Research’s January Freight Forecast shows that winter storms in late December and early January temporarily tightened availability and lifted spot rates, but much of this strength is tied to episodic disruptions rather than a sustained demand recovery.

Reefer continues to outperform other TL segments on relative stability, supported by essential cold-chain freight, but pricing power remains constrained by ample equipment availability and uneven volume trends across nonessential categories.

Spot Market Rates

Reefer spot rates surged into late December and early January as winter storms disrupted networks and seasonal food movements increasingly pushed into January. ACT data show reefer spot rates posting strong year-over-year gains during this period, driven by capacity dislocations rather than broad-based volume growth.

As weather impacts ease and seasonal food demand normalizes, ACT expects reefer spot rates to retrace some of these gains through late January and February. Load activity improved temporarily during weather events, but underlying trends continue to point to a structurally oversupplied market as produce volumes slow and equipment availability increases.

Food and pharmaceutical freight remain the most consistent sources of demand, while volumes tied to beverages, consumer-packaged goods, and discretionary perishables continue to lag. This imbalance continues to cap sustained pricing momentum despite recent volatility.

Contract Market Rates

Reefer contract rates have remained relatively stable entering 2026. Shippers continue to leverage soft volumes and available capacity to limit rate escalation, even as refrigerated carriers face rising costs tied to insurance, maintenance, labor, and regulatory compliance.

Essential cold-chain freight continues to provide a pricing floor, but carriers report limited success securing meaningful contract increases. ACT’s January outlook points to largely flat contract pricing in the near term, with sustained upward pressure unlikely until capacity tightens more decisively later in 2026.

Outlook

The reefer segment remains more insulated than dry van or flatbed due to its essential freight base, but overall pricing power remains limited. Recent spot rate gains were driven primarily by winter weather and seasonal timing rather than a fundamental improvement in demand, and ACT expects pricing to soften as those effects fade.

Looking ahead through 2026, tariff-driven equipment cost inflation, elevated insurance and maintenance expenses, and lingering uncertainty around EPA 2027 compliance costs will continue to shape fleet investment behavior. Many refrigerated fleets are extending trade cycles, limiting new equipment purchases, and prioritizing asset reliability and uptime over expansion.

Absent a sustained rebound in consumer-driven cold-chain demand or a sharper reduction in reefer capacity, ACT Research expects the reefer market to remain broadly flat with episodic volatility into early 2026, with more durable improvement pushed toward midyear as capacity contraction gradually takes hold.

To see how reefer rates are projected to evolve, and for detailed TL, LTL, and intermodal forecasts, see ACT’s Freight & Transportation Forecast.

Reefer capacity has loosened modestly entering 2026, with load activity easing as produce volumes slow and excess equipment re-enters the market following the seasonal peak. Spot rates surged in late December and early January on winter weather disruptions and shifting seasonal food movement, but ACT expects that strength to retrace as networks normalize. Even so, the segment remains more resilient than dry van or flatbed, supported by steady food, healthcare, and core cold-chain demand. Elevated operating costs, tighter capital conditions, and restrained fleet investment are limiting downside rate pressure, allowing reefer pricing to hold firmer than broader truckload benchmarks despite softening seasonal demand, episodic volatility, and moderating consumer-driven freight.

Tim Denoyer

Vice President & Senior Analyst

Resources

Whether you’re new to our company or already a subscriber, we encourage you to take advantage of all our resources.