Freight Trucking Rates

Truck Freight Rates: February 2026 Van, Reefer & Flatbed Update

ACT Research provides consolidated, forward-looking freight rate analysis — helping carriers, brokers, and shippers plan contract strategy with confidence.

Freight & Trucking Rate Update

February 26, 2026

As of February 2026, the freight and trucking industry is entering the year with firmer momentum than previously expected following a weather-intensified tightening cycle that began late in 2025. While underlying goods demand remains mixed and inventory behavior cautious, accelerating capacity contraction, regulatory shifts affecting driver supply, and stronger spot activity have meaningfully tightened the market entering Q1. Winter storms across the Midwest and Eastern U.S. materially disrupted networks in January and early February, amplifying rate pressure in an already tightening environment.

Unlike prior weather events in 2024–2025, February’s spot rate strength reflects not just episodic disruption but also structurally leaner capacity. Spot truckload rates, net fuel, were running more than 20% higher year-over-year in early February, with load postings up sharply and the load-to-truck ratio moving to multi-year highs. While a seasonal moderation is still expected as weather effects fade, rate floors appear to be forming at higher levels than seen throughout most of 2024 and 2025.

Below are the latest insights on dry van, flatbed, and reefer rates based on ACT Research’s February 2026 Freight Forecast.

Dry Van

Dry van spot rates accelerated materially through January and into early February as multiple winter storms tightened capacity across the Midwest, Great Lakes, and Eastern regions. Unlike prior winter spikes, this move was amplified by a thinner carrier base following prolonged capacity attrition in 2024–2025. Spot rates are tracking roughly 20% higher year-over-year in February, with load postings and load-to-truck ratios signaling significantly tighter conditions than at any point over the past twelve months.

ACT expects some retracement as seasonal normalization occurs and weather-related backlogs clear. However, with operating authorities declining and fleets still reluctant to expand capacity meaningfully, dry van rates are likely to revert to higher lows rather than collapse back to prior trough levels. Sustained upside will depend on continued freight demand improvement through the spring.

Flatbed

Flatbed spot rates tightened modestly during weather disruptions but continue to lag dry van and reefer in overall momentum. Industrial freight remains uneven, with construction, housing, and certain manufacturing segments still soft. However, infrastructure spending, utility investment, and data-center buildouts are providing pockets of stability.

Capacity remains more balanced in flatbed than in prior months, but not yet tight enough to generate strong pricing power. Flatbed rate upside remains more dependent on a broader industrial recovery than on weather-driven tightening alone.

Reefer

Reefer spot rates have been the standout performer entering February. Weather disruptions combined with evolving seasonal food shipment patterns pushed reefer rates toward approximately 25% year-over-year gains in early February. The reefer market has tightened more quickly than dry van, reflecting both weather dislocations and a reduced availability of specialized capacity.

While some normalization is expected as produce flows stabilize and weather impacts fade, 2026 full-year reefer rate expectations have been revised higher. Capacity contraction and regulatory-driven driver supply constraints are creating a firmer structural backdrop than previously assumed.

Contract Rates

Dry Van

Dry van contract rates are beginning to respond to the sustained strength in the spot market. While bid cycles remain measured, carriers are reporting modest contract rate increases in the low-single-digit range, with expectations for additional upward pressure later in the year if spot conditions hold. Shipper leverage has narrowed modestly but has not fully reversed.

Flatbed

Flatbed contract rates remain relatively soft compared to historical norms, reflecting the still-fragile state of industrial freight. While spot stabilization is constructive, contract pricing acceleration will likely require more consistent industrial demand growth before material upward movement occurs.

Reefer

Reefer contract rates have begun to show early signs of upward pressure as sustained spot strength filters into negotiations. Carriers continue to face elevated insurance, maintenance, and compliance costs, and tightening capacity is gradually improving negotiating leverage. Meaningful contract acceleration, however, will depend on whether current spot rate floors hold through the spring.

Summary

Entering February 2026, the freight market is firmer than it was at any point during 2025, though still early in a recovery phase. Recent spot rate gains were initially weather-driven but have been reinforced by measurable capacity contraction and improving freight fundamentals. Contract rates are beginning to firm modestly, particularly in dry van and reefer, though broad-based pricing power has not yet returned.

Carriers continue to navigate elevated input costs, embedded tariff-driven equipment inflation, regulatory-driven driver uncertainty, and still-recovering margins. Many fleets remain disciplined in capital deployment, focusing on replacement timing, asset optimization, and risk management rather than aggressive expansion.

While volatility should be expected through the first half of 2026, the structural setup has improved. Continued capacity contraction, regulatory clarity, and gradually strengthening freight demand now support a more constructive outlook for the balance of 2026, with a more durable recovery increasingly dependent on sustained rate floors rather than short-term dislocations.

To see how freight trucking rates change in the future, and for detailed analysis and forecasts, see ACT's freight & transportation forecast.

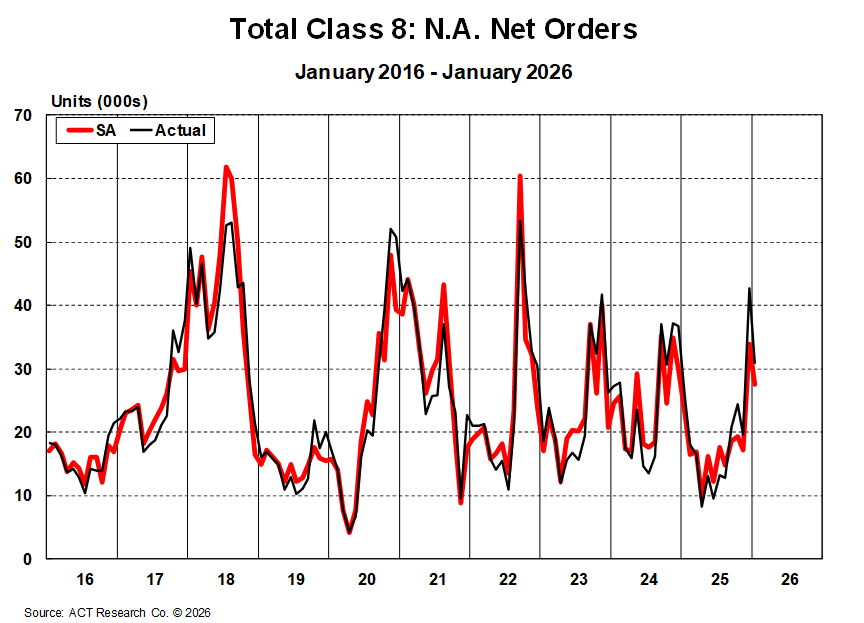

While contract rates are beginning to show measurable upward movement and spot rates remain materially higher year-over-year despite expected seasonal retracement, the late-2025 and early-2026 rebound in Class 8 orders has not yet translated into broad-based expansion behavior. Backlogs have improved from cycle lows and tractor inventories are healthier following disciplined production cuts, but for-hire carrier profitability remains uneven and still below levels that would typically support aggressive fleet growth. With §232 tariffs fully embedded in equipment pricing—keeping acquisition and lifecycle costs elevated—and financing, insurance, and total cost-of-ownership pressures still high, fleets remain selective in capital deployment. The recovery path now appears less dependent on a sudden freight surge and more anchored in ongoing structural capacity contraction, tightening operating authorities, and firmer rate floors. Although regulatory clarity around EPA’s 2027 low-NOx framework has reduced uncertainty and revived prebuy discussions, most fleets continue to approach 2026 equipment strategies through the lens of replacement timing, regulatory positioning, cost control, and operational flexibility rather than outright expansion.

Tim Denoyer

VP & Sr. Analyst

Resources

Whether you’re new to our company or are already a subscriber, we encourage you to take advantage of all our resources.