Class 8 Truck Orders

Class 8 Truck Orders in January 2026

Updated January 26, 2026

Class 8 Truck Orders

January 2026 Update

As of January 2026, the Class 8 truck market is entering the year at an inflection point following a volatile finish to 2025. Freight demand remains uneven and tariff-related cost pressures persist, but a late-2025 improvement in spot rates, incremental EPA 2027 regulatory clarity, and an aging tractor population have begun to shift fleet sentiment. Carrier profitability remains constrained, yet confidence has stabilized modestly after an extended downturn.

Public carriers continue to operate with compressed margins, while private fleets remain disciplined in capital allocation. Fleet investment is still primarily replacement-driven rather than growth-oriented; however, deferred replacement needs are becoming more difficult to push out. While overall demand remains below long-term historical norms, ongoing capacity contraction across the for-hire market is creating the foundation for a gradual rebalancing as 2026 unfolds.

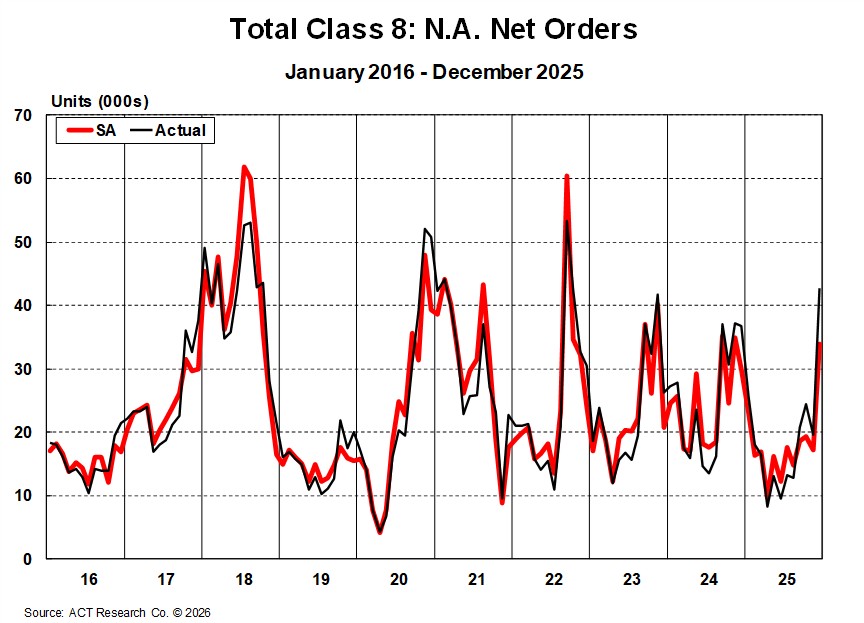

Preliminary North American Class 8 net orders surged to roughly 42,700 units in December, providing a strong closing signal for 2025 and reshaping the near-term outlook entering January. Tractor orders drove the increase, reflecting renewed engagement from large for-hire fleets responding to higher freight rates, improved regulatory visibility around EPA 2027, and incentives to secure equipment ahead of anticipated cost increases.

The long-anticipated year-end order surge finally materialized, though the magnitude of December’s activity suggests a catch-up effect rather than the start of a sustained acceleration. Cancellations remained relatively contained, while backlog levels expanded meaningfully after spending much of 2025 near cycle lows. OEMs continue to emphasize production discipline, but the late-year order strength has modestly improved orderboard visibility into early 2026.

Production cuts implemented throughout 2025 have helped normalize tractor inventories, which now sit in healthier alignment with retail demand. Vocational inventories remain elevated and slower to correct, particularly in construction- and energy-adjacent segments. OEM build schedules remain conservative entering 2026, with output closely aligned to backlog levels rather than speculative demand growth.

The §232 heavy-vehicle tariffs, tied directly to foreign content value, remain embedded in OEM pricing and continue to weigh on equipment affordability. These costs are especially impactful for units sourced from Mexico, which accounts for roughly one-third of North American Class 8 production. When combined with elevated financing, insurance, and total cost-of-ownership pressures, fleets remain selective, prioritizing timing and regulatory strategy over multi-unit expansion.

Class 8 Truck Orders Snapshot

Entering January 2026, Class 8 order activity reflects a market transitioning off the bottom rather than one fully recovering. December orders far exceeded replacement demand and broke from the depressed seasonal pattern that defined most of 2025, while seasonally adjusted order rates jumped to their highest levels in more than a year.

OEMs continue to manage daily build rates carefully into 2026 to preserve backlog alignment and protect margins. Dealer feedback points to still-soft underlying retail activity outside of year-end tax-driven and strategic purchases, and used truck values remain under pressure—signaling that excess capacity is still being absorbed.

Absent sustained improvement in carrier profitability and a clearer inflection in freight demand, ACT Research expects the Class 8 market to remain uneven through early 2026. While capacity contraction is continuing beneath the surface, a durable and broad-based order recovery is more likely to emerge later in 2026, with stronger upside potential extending into 2027 as freight, regulatory, and macroeconomic conditions better align.

With tractor orders rebounding sharply at year-end after a prolonged stall, orderboards beginning to refill from historically low levels, and OEMs maintaining disciplined build rates, the Class 8 market’s 2025 challenge has shifted decisively—from managing excess backlog to navigating a fragile early-cycle transition defined by uneven profitability, elevated costs, and policy-driven timing decisions. While regulatory clarity around EPA’s 2027 low-NOx rule has improved—with core technology requirements remaining and extended warranty provisions likely falling away—tariff-driven price inflation under §232 is now fully embedded in OEM pricing and continues to weigh on equipment affordability. Vocational demand has shown relative resilience, supported by utility, data center, and infrastructure activity, but broader freight softness, tight capital conditions, and still-depressed carrier margins are keeping most fleets focused on replacement timing, asset efficiency, and risk mitigation rather than broad-based expansion across the commercial vehicle ecosystem.

Kenny Vieth

President & Senior Analyst

Resources

Whether you’re new to our company or already a subscriber, we encourage you to take advantage of all our resources.