Trucking Industry 2027 Outlook - January 2026

Updated January 26, 2026

The trucking industry’s outlook for 2027 continues to be shaped by elevated equipment costs, lingering policy risk, and a slow, uneven recovery from the longest for-hire downturn on record. While clearer early-cycle signals are emerging—most notably accelerating capacity contraction and improving supply discipline—long-term planning remains constrained by uneven freight demand, compressed carrier margins, and tariff-driven cost inflation. Regulatory uncertainty has narrowed further entering 2026, with stronger indications that EPA intends to retain core low-NOx technology requirements while eliminating or revising extended warranty provisions. Even so, higher equipment prices in 2027 now appear firmly locked in, keeping fleets focused on replacement timing, flexibility, and balance-sheet protection rather than expansion.

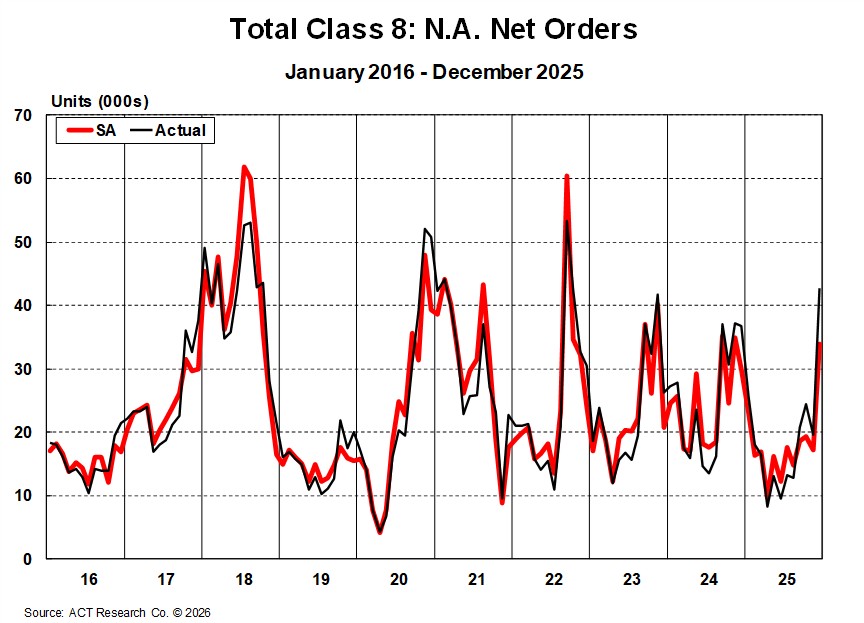

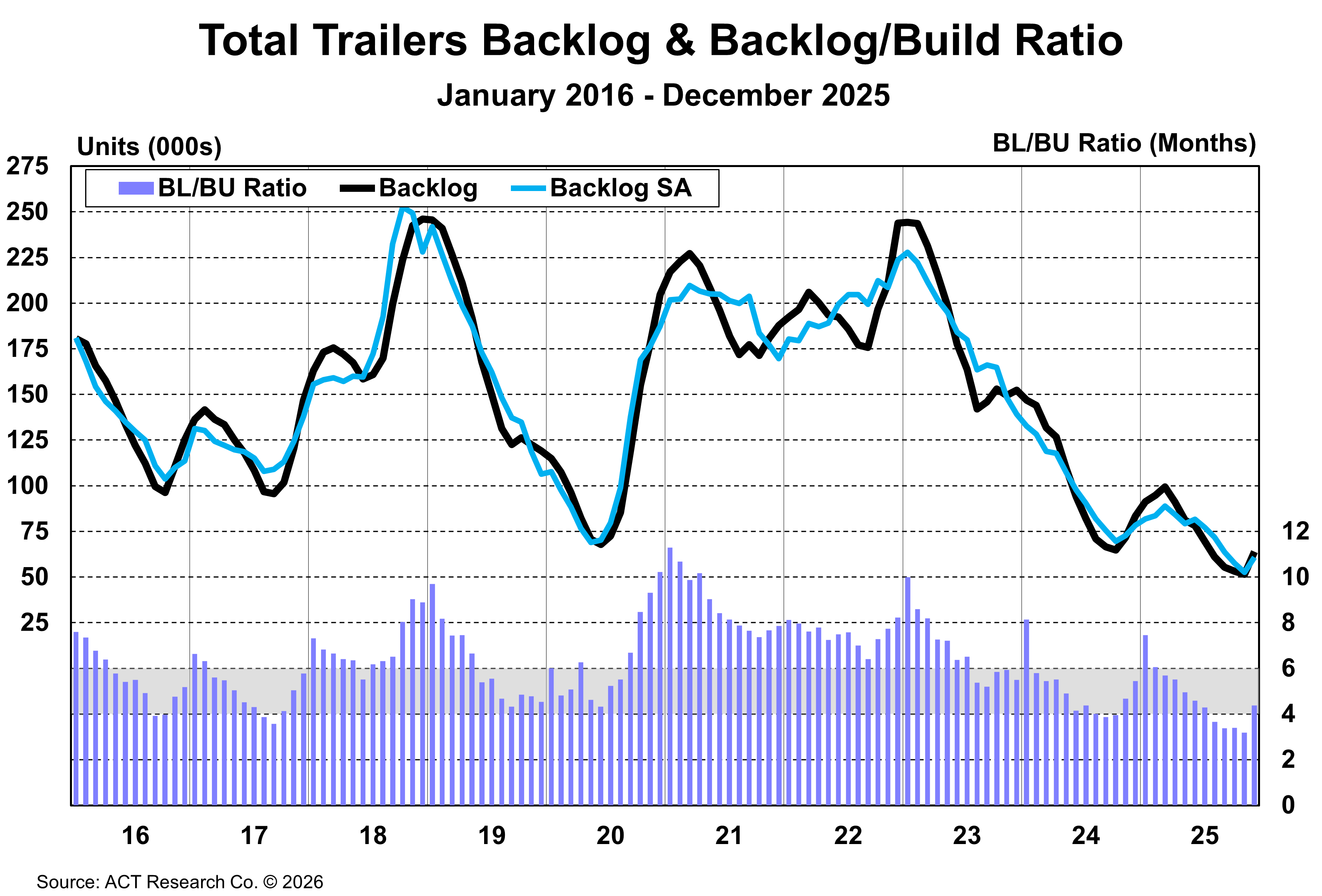

Production and ordering data entering 2026 continue to reflect this defensive posture. While December 2025 Class 8 orders rebounded sharply, ACT Research continues to view that surge as a catch-up event rather than confirmation of sustained momentum, and broader order trends remain well below historical cycle norms. Medium-duty demand continues to trail long-term averages, and trailer orders—despite intermittent improvement—remain insufficient to rebuild historically thin backlogs. OEMs remain disciplined, aligning production closely with limited order visibility and prioritizing margin protection. Elevated vocational inventories and uneven freight demand reinforce a market anchored in replacement activity rather than growth as fleets look toward 2027.

3 Key Trends Impacting Trucking & Transportation in 2027

Fleet Planning Under Narrowing—but Costly—Regulatory Clarity

1. EPA 2027 compliance remains the most influential variable shaping long-term fleet planning. January updates reinforce expectations that the rule will preserve emissions technology requirements while removing or scaling back extended warranty and useful-life provisions. This has reduced regulatory uncertainty but confirmed structurally higher equipment prices beginning in 2027. As a result, aggressive prebuy strategies remain limited, constrained by weak carrier balance sheets, elevated interest rates, and tight credit conditions.

2. Tariff-induced cost inflation remains firmly in place. §232 heavy-vehicle tariffs are fully embedded in new-equipment pricing—particularly for vehicles with imported or mixed content—materially increasing acquisition costs. When combined with higher insurance, maintenance, and financing expenses, total cost of ownership remains elevated. Fleets continue to extend trade cycles, prioritize essential replacement, and emphasize liquidity and flexibility as they prepare for another year of constrained capital deployment.

3. Infrastructure Investment Provides Selective Support

Infrastructure-aligned freight remains one of the more durable sources of demand heading toward 2027. Vocational demand, while well below prior-cycle highs, continues to benefit from utility, data center, and municipal work, as well as longer-cycle infrastructure projects. That support, however, remains uneven, as delays in project execution, labor availability, and elevated input costs continue to temper upside.

Trailer market dynamics reflect a similar pattern. Backlogs remain historically low despite occasional order improvement, and OEMs continue to characterize forward orderboards as underwhelming. Flatbed and platform equipment continue to outperform vans and reefers on a relative basis, supported by infrastructure- and energy-adjacent activity, but overall purchasing remains cautious. Improved lead times and selective replacement demand provide stability, though meaningful expansion remains unlikely.

Profitability, Pricing Power, and Capital Discipline

Carrier profitability remains challenged as fleets plan for 2027. For-hire carriers continue to operate with depressed margins despite accelerating capacity contraction. Spot rate strength observed during late-2025 and early-2026 weather disruptions is increasingly viewed as episodic rather than structural, with pricing power still limited by uneven demand and residual excess capacity. Contract rate improvement has been incremental and remains insufficient to fully offset rising operating and capital costs.

This profitability backdrop continues to reinforce disciplined capital strategies across the industry. Fleet budgets remain focused on maintenance, equipment life extension, and targeted efficiency investments—such as fuel-saving technologies, idle reduction, and network optimization—rather than capacity growth. With freight demand expected to improve only gradually through 2026, carriers remain focused on liquidity preservation and operational resilience as they look ahead.

Until freight fundamentals strengthen more decisively and the benefits of sustained capacity contraction are fully realized, the trucking industry’s 2027 outlook remains defined by cost control, capital discipline, and cautious fleet planning—reflecting a continuation of the slow, uneven normalization process that began in late 2024 and is expected to extend well into the next cycle.

Stay Ahead with Smarter Freight Insights

Success in trucking and freight comes from knowing what’s next—not just what’s now. At ACT Research, we deliver forward-looking market intelligence that helps you anticipate shifts, prepare for cycles, and stay strategically positioned. As your trusted transportation intelligence partner, we give you the tools to act with confidence—so you can optimize operations, reduce risk, and drive stronger profitability.