Trucking Industry 2026 Outlook

January 2026

Updated January 26, 2026

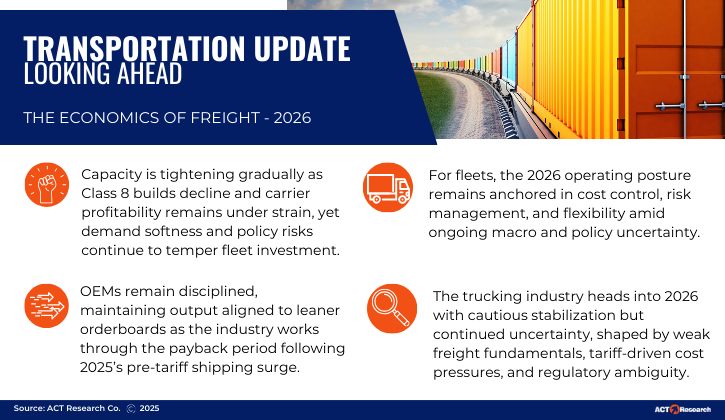

The trucking industry enters 2026 at an important inflection point, transitioning from a prolonged downcycle toward early-stage rebalancing—but not yet recovery. Freight demand remains uneven and below historical norms, while tariff-driven cost inflation and elevated financing expenses continue to weigh on fleet economics. At the same time, capacity contraction is accelerating as weak profitability, disciplined OEM production, and sub-replacement equipment purchases reshape the supply landscape.

OEMs remain highly disciplined, aligning production closely with thin orderboards and prioritizing margin protection over volume growth. While regulatory clarity has improved around EPA 2027, higher equipment prices are now firmly embedded into future cost structures, reinforcing a cautious, replacement-focused approach to capital deployment. As a result, 2026 is shaping up as a transition year—defined by stabilization, selective renewal, and operational discipline rather than expansion.

Freight, Capacity, and Market Balance

Freight volumes enter 2026 on a soft footing following the unwind of pre-tariff shipping activity and late-year seasonal normalization. Weather-related disruptions in December and early January created short-term volatility, but underlying demand fundamentals remain fragile across many freight-generating sectors.

Despite muted demand, the supply side of the market is adjusting more visibly. The highway Class 8 tractor population is contracting at an accelerating pace, driven by depressed build rates, elevated carrier exits, and prolonged trade cycles. Tractor inventories are approaching healthier levels, though vocational and trailer inventories remain slower to correct.

ACT Research expects rebalancing to continue gradually through 2026. While capacity contraction is real and ongoing, supply still exceeds demand in most segments, limiting near-term pricing power and reinforcing a defensive operating posture across the industry.

Equipment Markets and Fleet Behavior

Class 8 Trucks

Class 8 production remains constrained entering 2026, reflecting weak underlying freight conditions and continued margin pressure on carriers. Late-2025 order volatility improved sentiment modestly, but fleet purchasing behavior remains overwhelmingly replacement-driven. Higher equipment prices tied to §232 tariffs, elevated insurance and financing costs, and lingering uncertainty around freight recovery continue to suppress growth-oriented investment.

Medium Duty (Classes 5–7)

Medium-duty markets remain soft as 2026 begins. Demand is constrained by slowing services growth, cautious consumers, and body-builder bottlenecks that continue to limit throughput. Inventories remain elevated despite production adjustments, reinforcing OEM caution and disciplined build plans.

Trailers

Trailer demand remains subdued, with backlogs well below historical norms. Excess parked capacity, weak carrier profitability, and limited urgency to commit capital continue to weigh on orders. Dry vans and reefers remain the weakest segments, while flatbeds are relatively more resilient due to selective infrastructure, utility, and energy-related demand. Production plans remain conservative as OEMs prioritize inventory alignment.

Regulatory and Cost Environment

Regulatory clarity improved entering 2026, particularly around EPA’s 2027 low-NOx rule. Current guidance suggests core emissions technology requirements will remain, while extended warranty and useful-life provisions may be revised or removed. This has reduced uncertainty but confirmed that higher Class 8 equipment prices in 2027 are likely.

Tariffs remain a defining cost driver. §232 heavy-vehicle tariffs are fully embedded in equipment pricing and continue to inflate acquisition costs, especially for Mexico-sourced units. When combined with higher interest rates, insurance premiums, and compliance expenses, total cost of ownership remains elevated—keeping fleet capital strategies conservative.

Zero-emission adoption continues in targeted applications such as drayage, urban delivery, and utility fleets, where incentives and infrastructure support exist. Broader adoption remains limited by high upfront costs, infrastructure gaps, and evolving policy frameworks.

Outlook for 2026

The trucking industry is not entering 2026 in recovery mode—but it is no longer in free fall. Capacity contraction is gaining traction, regulatory uncertainty has narrowed, and equipment markets are slowly rebalancing. However, freight demand remains uneven, and cost pressures continue to challenge profitability.

ACT Research views 2026 as a foundational year: one in which the industry continues to work through excess capacity, stabilize operations, and position for a more durable recovery beyond the near term. Success in 2026 will depend less on demand acceleration and more on discipline—across fleets, OEMs, and the broader transportation ecosystem.

Stay Ahead with Smarter Freight Insights

Success in trucking and freight comes from knowing what’s next—not just what’s now. At ACT Research, we deliver forward-looking market intelligence that helps you anticipate shifts, prepare for cycles, and stay strategically positioned. As your trusted transportation intelligence partner, we give you the tools to act with confidence—so you can optimize operations, reduce risk, and drive stronger profitability.