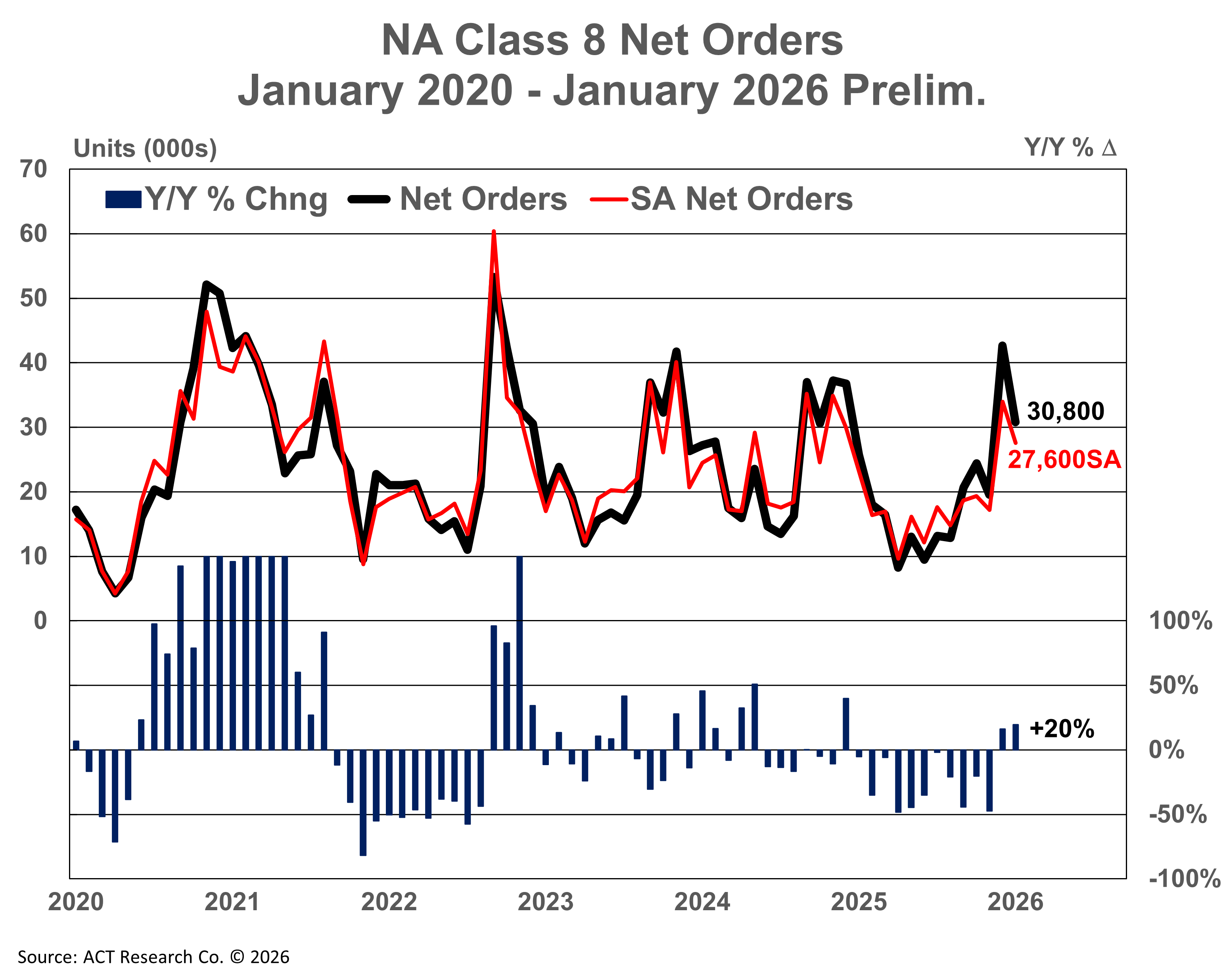

December preliminary North America Class 8 net orders of 30.8k units increased 20% y/y. Complete industry data for January, including final order numbers, will be published by ACT Research in mid-February.

“After a weak October and November, a few things have happened that, in our thinking, have helped spur recent order activity. The US economy continues to outperform expectations, clarity surrounding EPA’27 bolstered demand, and arguably most importantly, since the end of November, we’ve seen a sustained run up in spot rates after three successive Midwest snowstorms,” shared Carter Vieth, Research Analyst at ACT Research.

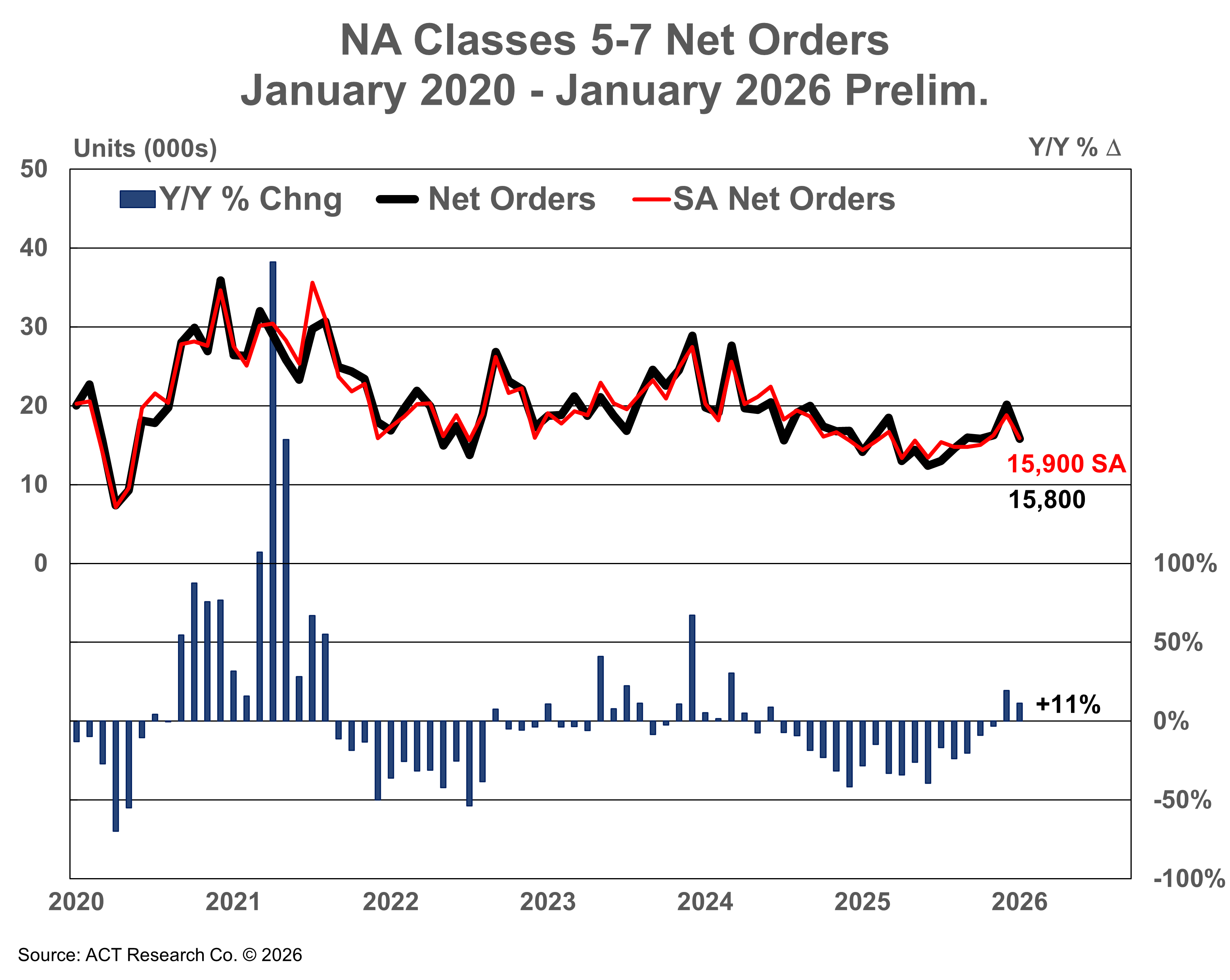

Regarding medium duty, he added, “Medium-duty preliminary orders in January totaled 15,800 units, up 11% y/y. Given last January was the weakest January for orders since 2013, the 11% improvement seems to be more of an easy comp than meaningful improvement.”

State of the Industry: NA Classes 5-8 Report Overview

ACT’s State of the Industry: NA Classes 5-8 report provides a monthly look at the current production, sales, and general state of the on-road heavy and medium duty commercial vehicle markets in North America. It differentiates market indicators by Class 5, Classes 6-7 chassis and Class 8 trucks and tractors, detailing measures such as backlog, build, inventory, new orders, cancellations, net orders, and retail sales. Additionally, Class 5 and Classes 6-7 are segmented by trucks, buses, RVs, and step van configurations, while Class 8 is segmented by trucks and tractors with and without sleeper cabs. This report includes a six-month industry build plan, backlog timing analysis, historical data from 1996 to the present in spreadsheet format, and a ready-to-use graph package. A first-look at preliminary net orders is also published in conjunction with this report.

ACT Research Overview

ACT Research is recognized as the leading publisher of commercial vehicle truck, trailer, and bus industry data, market analysis and forecasts for the North America and China markets. ACT’s analytical services are used by all major North American truck and trailer manufacturers and their suppliers, as well as banking and investment companies. ACT Research is a contributor to the Blue Chip Economic Indicators and a member of the Wall Street Journal Economic Forecast Panel. ACT Research executives have received peer recognition, including election to the Board of Directors of the National Association for Business Economics, appointment as Consulting Economist to the National Private Truck Council, and the Lawrence R. Klein Award for Blue Chip Economic Indicators’ Most Accurate Economic Forecast over a four-year period. ACT Research senior staff members have earned accolades including Chicago Federal Reserve Automotive Outlook Symposium Best Overall Forecast, Wall Street Journal Top Economic Outlook, and USA Today Top 10 Economic Forecasters. More information can be found at www.actresearch.net.

Additional Resources

Final North American Class 8 net orders totaled 42,684 units in December, up 16% y/y, as published in ACT Research’s latest State of the Industry: NA Classes 5-8 report.

“December’s massive 408k SAAR underscores its outlier performance, as for all of 2025, just 224k Class 8 orders were placed. Given carrier margins remained thin into the end of 2025, the sudden swing certainly overstates demand,” according to Carter Vieth, Research Analyst at ACT Research.

“There are several factors we think drove the surge. For starters, the economy, supported by AI and wealthy households, continues to outperform expectations, with GDP rising 4.3% in Q3. Crucially for trucking, consumer spending remains robust,” he continued. “On top of the firmer economic footing going into 2026, spot rates surged through November/December, helped on by weather and quickening capacity contraction. Lastly, the ATA announcement regarding EPA’27 added much needed regulatory clarity and likely drove some decision making in December.”

Regarding medium duty, Vieth added, “Total Classes 5-7 orders rose 20% y/y to 20,126 units. Having gradually slowed in 2025 on tariffs and low consumer sentiment, December’s improvement is likely a reflection of continued consumer spending strength, cautious optimism surrounding IEEPA tariffs, and some regulation-driven dealer stocking.”

Class 8:

Net Orders: 42,684

Classes 5-7:

Net Orders: 20,126

Click here to learn more information about ACT's State of the Industry: NA Classes 5-8 Vehicles data.

ACT Research is featured regularly by major news outlets for our work covering Class 8 truck orders, sales, forecasting, used truck sales, freight rates, trailer sales, and much more. Get more trends, HERE.

Save time with ACT Research’s media kit. Access ACT Research’s analyst bio, logos, press releases, video library, and more at your convenience. Our analysts are committed to delivering the most accurate data and forecasts. Looking for a speaker? Each analyst is available to speak at your conference or event. Access Media Kit Here.