Dry Van Rates

Dry Van Rates - January 2026

Update January 26, 2026

Dry Van Truckload (TL) Sector

January 2026 Update

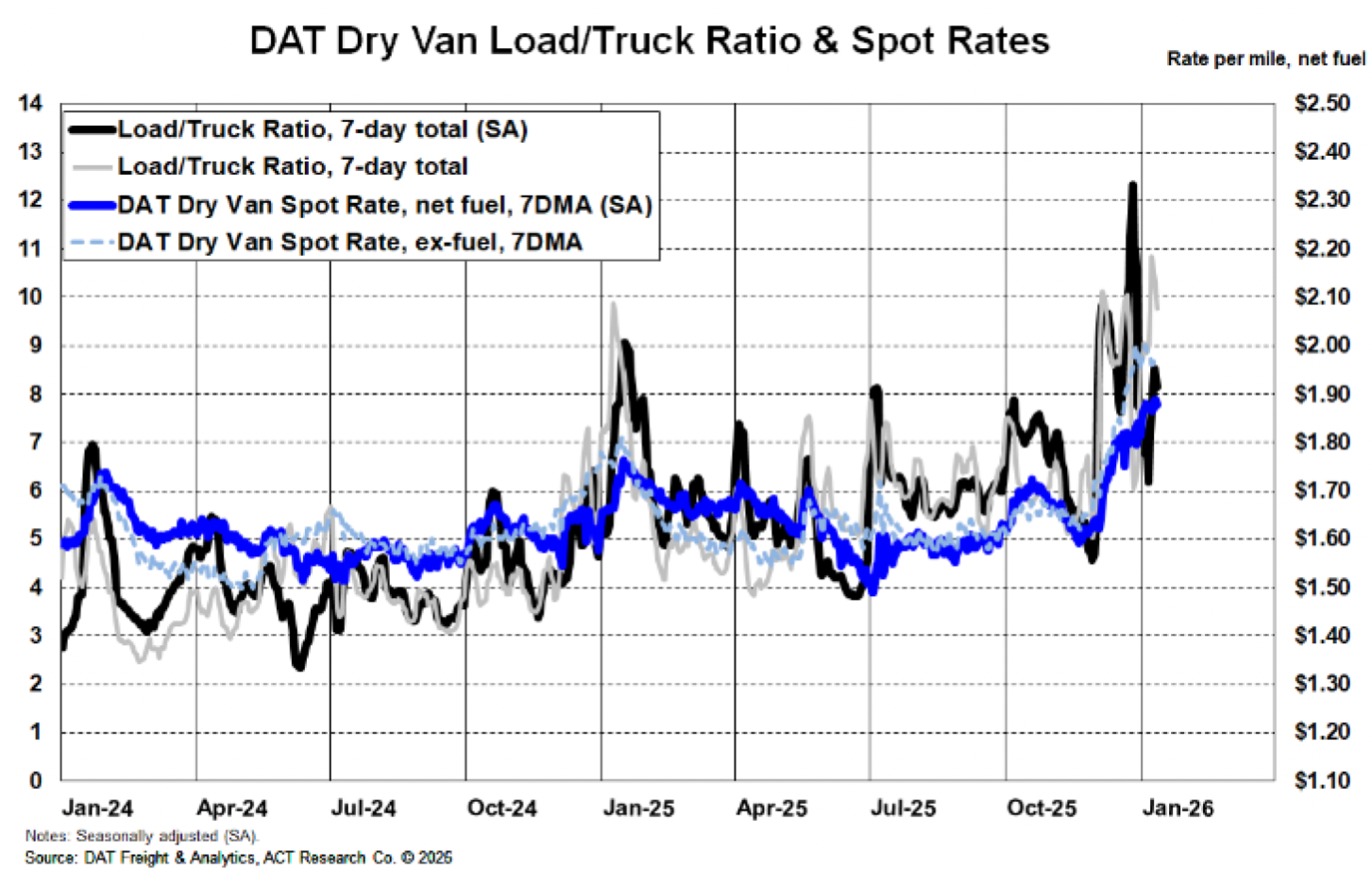

As of January 2026, the dry van truckload (TL) sector is entering the year at a fragile inflection point following a weather-disrupted close to 2025. Underlying freight demand remains soft, and tariff-driven cost inflation continues to pressure fleet economics, but accelerating capacity contraction is beginning to tighten the market at the margins. Winter storms in December and early January temporarily constrained capacity and lifted spot rates, though ACT Research emphasizes that these gains are largely episodic rather than reflective of a structural demand recovery.

According to ACT Research’s January Freight Forecast, capacity still exceeds freight volumes despite ongoing fleet attrition. Regulatory uncertainty has eased further with improved clarity around EPA 2027 low-NOx requirements, reducing one major overhang on fleet decision-making. However, higher equipment costs tied to §232 tariffs, elevated financing expenses, and still-compressed carrier profitability continue to suppress investment appetite. Private fleet capacity is beginning to edge lower but remains a headwind for for-hire carriers as 2026 begins.

Spot Market Rates

Dry van spot rates surged in late December and early January as multiple winter storms disrupted operations across the Midwest and Great Lakes regions, coinciding with shifting seasonality and lingering holiday freight. Load postings spiked, routing guides tightened, and spot pricing rose sharply on a year-over-year basis. ACT cautions that much of this strength is weather-driven and likely to fade as networks normalize and seasonal demand softens through late January and February.

Outside of these disruptions, retail and consumer-goods freight remains subdued. Lean inventories, moderating consumer spending, and uneven import flows continue to cap sustained volume recovery. ACT characterizes current conditions as a market where “weather and policy shocks create volatility atop still-soft fundamentals,” with elevated rate swings expected to persist into early 2026.

Contract Market Rates

Dry van contract rates edged modestly higher entering 2026, supported by firmer spot benchmarks and incremental tightening. However, contract negotiations remain measured, and shipper leverage largely persists given ample capacity and cautious freight outlooks.

Early-2026 bid activity continues to center on modest, low-single-digit increases, broadly consistent with ACT’s January forecast. With margins still under pressure, carriers remain focused on:

- Equipment lifecycle extension

Asset productivity improvements

Maintenance, insurance, and fuel cost control

Operational efficiency over network expansion

Tariff-driven equipment price inflation, higher interest rates, and rising ownership costs continue to restrain replacement activity and discourage growth-oriented purchases.

Outlook

The dry van TL market remains defensive as 2026 begins, with recent spot rate gains driven primarily by winter weather rather than a fundamental improvement in demand. While capacity contraction is accelerating beneath the surface, it has not yet translated into sustained pricing power.

Consumer demand remains uneven, inventories are lean, and freight-generating sectors show limited momentum entering the year. Although regulatory clarity around EPA 2027 has improved and spot rates are beginning to show higher lows, tariff-related cost pressures and tight credit conditions continue to reinforce extended trade cycles and conservative fleet behavior.

Absent a durable improvement in freight demand or a material shift in tariff policy, ACT Research expects the dry van segment to remain oversupplied and margin-constrained through early 2026, with a more durable recovery increasingly dependent on continued capacity contraction rather than near-term demand growth.

As of January 2026, dry van rates are rebounding off cycle lows but remain below long-term seasonal norms, with recent spot rate gains driven largely by winter weather disruptions rather than sustained demand strength. Late-December and early-January storms temporarily tightened capacity and lifted pricing, but those gains are already beginning to fade as networks normalize. With capacity still ample, inventories lean, and consumer goods freight uneven, the market continues to struggle to establish durable rate momentum entering 2026 despite accelerating capacity contraction beneath the surface.

Tim Denoyer

VP & Sr. Analyst

Resources

Whether you’re new to our company or are already a subscriber, we encourage you to take advantage of all our resources.