Canada Freight Rates

Canada Freight Rates -January 2026

Updated: January 26, 2026

Truckload Rates in Canada

January 2026

Canadian truckload rates entered January 2026 under continued pressure, though late-December and early-January winter weather disruptions briefly tightened conditions across parts of the country. The lift from pre-tariff shipping has fully unwound, and domestic freight demand remains soft amid slowing consumer activity and weaker industrial output. While Canadian capacity remains structurally tighter than in the U.S. following earlier fleet contraction, broad economic softness, declining imports, and subdued cross-border flows continue to weigh on rate performance. ACT Research’s January Freight Forecast highlights ongoing caution across both domestic and transborder markets.

Spot Market Rates

Intra-Canada Dry Van:

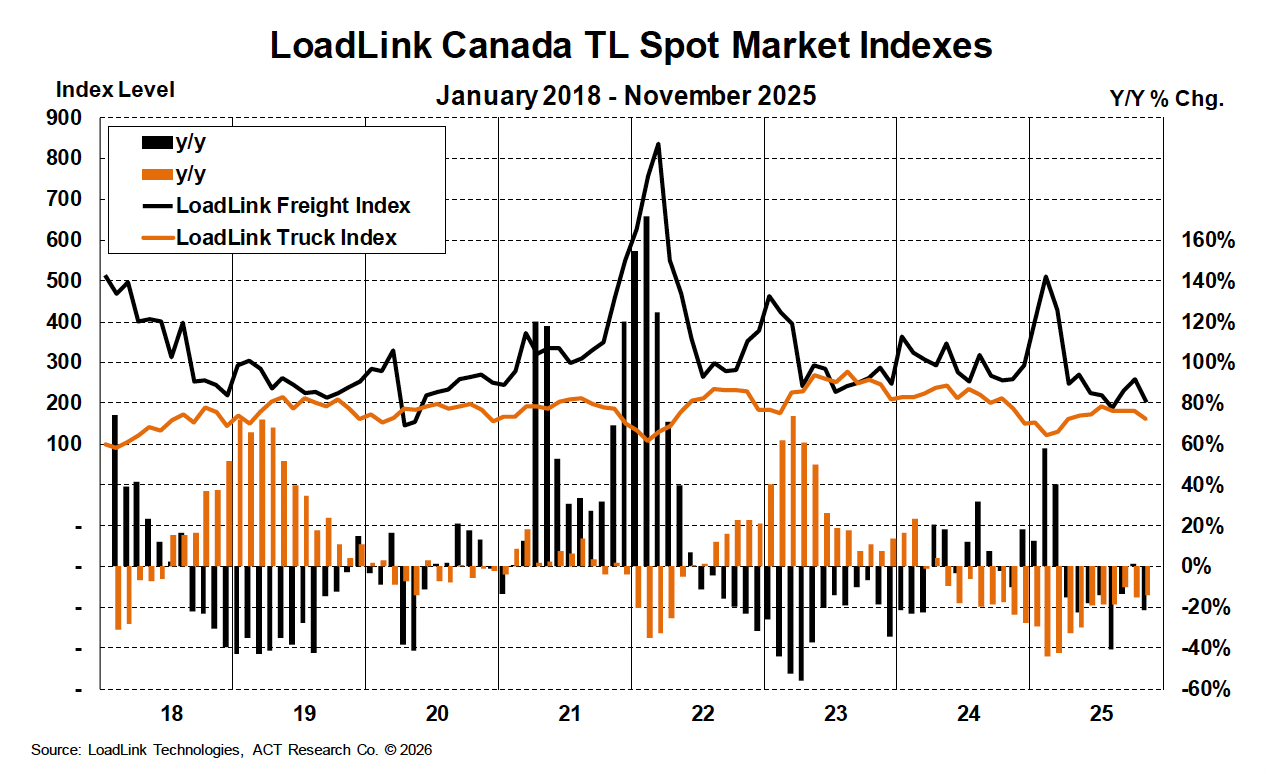

Intra-Canada dry van spot rates remained flat to modestly higher into late December and early January due to weather-related disruptions, but underlying demand conditions remain weak. Retail restocking remains limited, consumer spending is constrained, and manufacturing activity continues to lag. LoadLink’s Freight Index reversed its brief improvement late in 2025, signaling that baseline freight movement remains subdued despite episodic volatility.

Structurally tighter capacity relative to the U.S. continues to limit downside risk, but the overall market balance still favors shippers given muted demand and soft industrial activity.

U.S. to Canada:

Northbound rates remain under pressure entering 2026, reflecting softer U.S. freight conditions, declining import volumes, and cautious cross-border consumer-goods and manufactured-input flows. Tariff uncertainty and lean inventory strategies continue to suppress northbound demand.

ACT’s January outlook expects northbound pricing to remain flat to slightly weaker into early 2026, with any improvement dependent on a clearer rebound in U.S. goods demand and trade activity.

Canada to U.S.:

Southbound rates experienced brief tightening during late-December and early-January weather disruptions but have since drifted back toward recent baseline levels as volumes cooled and the load-to-truck ratio normalized. Export demand remains constrained by weak U.S. manufacturing activity and uneven consumer-goods flows.

Tariff-driven cost pressures, elevated operating expenses, and cautious U.S. buyers continue to weigh on Canadian export freight, limiting sustained upside for southbound pricing.

Outlook

Canadian truckload markets remain fragile entering 2026. Domestic demand is subdued, cross-border volumes are soft, and recent weather-related tightening has not altered the broader rate trajectory. Tariff-related input cost inflation, slowing retail activity, and weak manufacturing output continue to constrain recovery potential.

Looking ahead through 2026, the outlook remains closely tied to a recovery in U.S. freight demand and greater clarity around trade and tariff policy. Until those conditions improve, Canadian carriers are expected to remain focused on margin preservation, disciplined cost control, and selective capacity deployment—operating defensively in a market still defined by caution rather than growth.

To see how Canadian rates change in the future, and for detailed analysis and forecasts or truckload, less-than-truckload, and intermodal, see ACT's freight & transportation forecast.

Canada’s supply–demand balance remains relatively tight entering 2026, as earlier fleet contraction continues to partially offset soft freight volumes. Domestic spot rates have seen brief weather-related firmness but remain largely flat to slightly pressured as underlying demand stays subdued. Cross-border pricing—particularly southbound into the U.S.—continues to face headwinds from weak U.S. freight activity, slowing imports, and cautious manufacturing demand. Structurally limited equipment availability is helping cap the downside, but muted North American demand, tariff-related cost pressures, and ongoing policy uncertainty continue to weigh on the Canadian truckload market as 2026 begins.

Tim Denoyer

Vice President & Senior Analyst

Resources

Whether you’re new to our company or already a subscriber, we encourage you to take advantage of all our resources.