Class 8 Truck Orders

Class 8 Truck Orders in December 2025

Updated December 22, 2025

Class 8 Truck Orders

December 2025 Update

As of December 2025, the Class 8 truck market remains under significant pressure, with order activity continuing to underperform during what is typically one of the strongest booking periods of the year. Freight demand remains uneven, tariff-related cost pressures persist, and while EPA 2027 regulatory clarity has improved marginally, weak carrier profitability continues to suppress fleet confidence.

Public carriers remain stuck at recession-level margins, while private fleets continue to limit capital deployment. Fleet investment remains largely replacement-driven rather than growth-oriented, keeping Class 8 demand well below historical norms despite increasing signs of capacity contraction across the for-hire market.

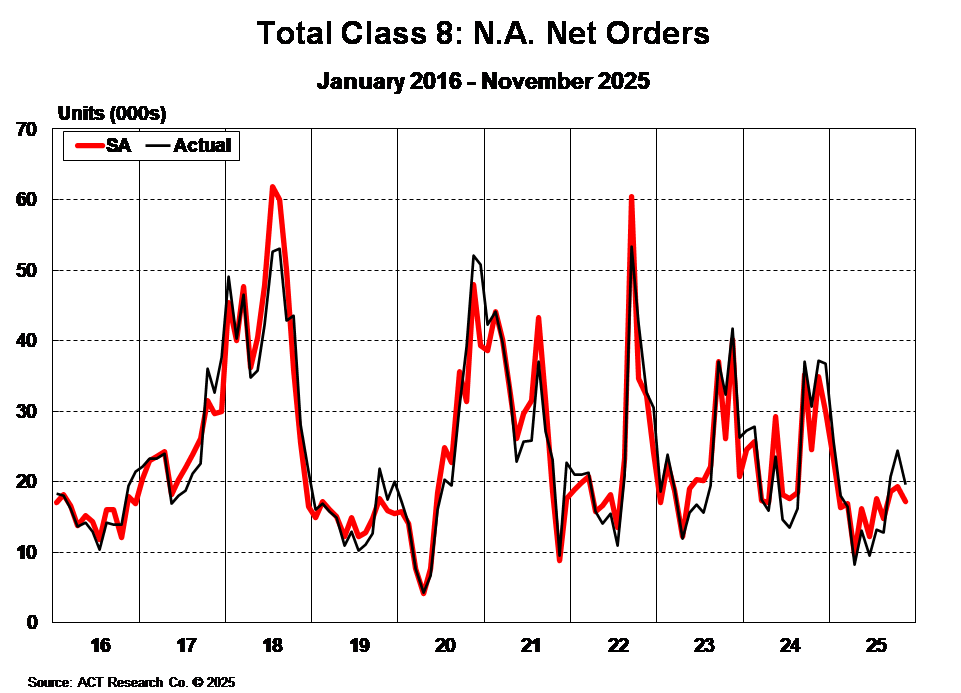

Preliminary North American Class 8 net orders totaled approximately 19,500 units in November, down year-over-year in what is typically one of the strongest order months of the year. Tractor orders were especially weak, reflecting the continued reluctance of for-hire fleets to commit capital amid soft freight conditions and elevated operating costs.

The traditional year-end “order surge” again failed to materialize, extending the multi-month trend of subdued demand. Cancellations remained relatively contained, but backlog levels stayed compressed as OEMs continued to manage production tightly in response to thin orderboards rather than improving demand.

Production cuts have driven modest backlog stabilization in recent months, though this reflects supply discipline rather than a demand recovery. Tractor inventories are gradually normalizing following extended production adjustments, while vocational inventories remain elevated and slower to correct, particularly in segments tied to construction and energy.

OEMs have carried conservative build schedules deeper into Q4, aligning output closely with weak order intake and constrained carrier profitability. Order visibility into early 2026 remains limited.

The §232 heavy-vehicle tariffs, tied directly to foreign content value, remain embedded in OEM pricing and continue to pressure equipment affordability. These costs are particularly impactful for units sourced from Mexico, which represents roughly one-third of North American Class 8 production. Combined with high financing, insurance, and total cost-of-ownership pressures, fleets continue to defer multi-unit commitments.

Class 8 Truck Orders Snapshot

Preliminary North American Class 8 net orders for November remained well below replacement demand and far under typical seasonal peaks. Seasonally adjusted order rates continue to track at depressed annualized levels, underscoring the defensive posture fleets have maintained through late 2025.

OEMs continue to reduce daily build rates and manage output carefully into 2026 to preserve backlog alignment and protect margins. Dealer feedback points to soft retail activity, while used truck values have resumed their downward trend—another signal the market is still digesting excess capacity.

Absent a meaningful improvement in carrier profitability or a sharper inflection in freight demand, ACT Research expects the Class 8 market to remain challenged into early 2026. While capacity contraction is accelerating beneath the surface, a sustained order recovery is unlikely before mid-2026, with stronger upside potential pushed into 2027 if freight, regulatory, and macro conditions align.

With tractor orders stalled, orderboards underbooked, and OEMs continuing to trim production, the Class 8 market’s 2025 challenge has shifted decisively—from managing excess backlog to navigating a replacement-only environment defined by weak profitability, elevated costs, and policy-driven uncertainty. While regulatory clarity around EPA’s 2027 low-NOx rule has improved—with technology requirements remaining and warranty provisions likely falling away—tariff-driven price inflation under §232 is now fully embedded in OEM pricing and continues to weigh on fleet purchasing decisions. Vocational demand has shown relative resilience, supported by utility and infrastructure activity, but broader freight softness, tight capital conditions, and recession-level carrier margins are keeping fleets focused on asset efficiency, cost control, and risk mitigation rather than expansion across the commercial vehicle ecosystem.

Kenny Vieth

President & Senior Analyst

Resources

Whether you’re new to our company or already a subscriber, we encourage you to take advantage of all our resources.