Class 8 Truck Market: 2025 in Review

Year-End Summary | January 2026

Executive Takeaway

The Class 8 truck market exits 2025 after one of the most prolonged and challenging downcycles in modern industry history. What began as a post-pandemic normalization evolved into a year defined by weak freight demand, historically poor carrier profitability, elevated equipment and operating costs, and persistent policy uncertainty. While pockets of activity—most notably pre-tariff pull-forward and select vocational segments—offered brief relief, they failed to produce sustained momentum. By year-end, fleet behavior across the Class 8 market was overwhelmingly defensive, centered on replacement timing, cost control, and liquidity preservation.

At the same time, 2025 marked a critical structural shift: capacity contraction is now firmly underway. Sub-replacement retail sales, disciplined OEM production, and mounting financial pressure on smaller carriers are reshaping the supply landscape, setting the stage for a gradual recovery beyond 2026.

Vocational Demand: A Floor, Not a Catalyst

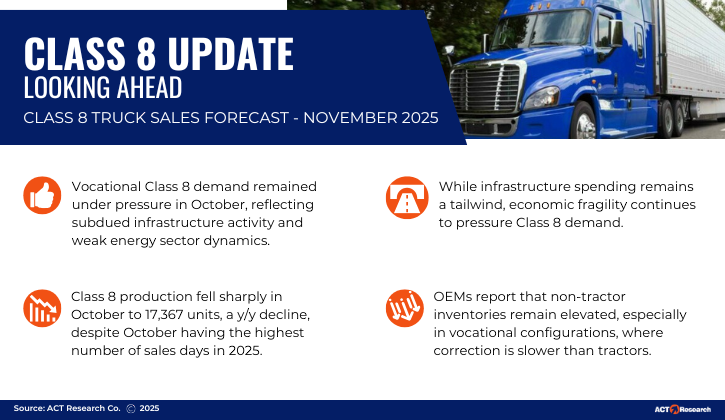

Vocational Class 8 demand remained under pressure throughout 2025, reflecting slow infrastructure execution, delayed project timelines, and ongoing weakness in energy-related activity. While federal infrastructure programs continue to provide a longer-term tailwind, actual project flow lagged expectations, constrained by permitting delays, higher material costs, and stretched municipal budgets.

Utility, municipal, and essential replacement demand provided a modest baseline of activity, but momentum faded as the year progressed. Housing-related construction and nonresidential development remained soft, limiting upside for vocational configurations. OEMs and dealers reported elevated vocational inventories throughout the year, underscoring how slowly supply is adjusting in non-tractor segments.

Overall, vocational demand helped stabilize the market but did not meaningfully offset broader weakness in freight-driven tractor demand.

Production Discipline and Thin Backlogs

OEMs maintained tight production discipline throughout 2025, aligning build rates with weak order intake and margin protection priorities. Class 8 production remained well below early-cycle expectations, reflecting recession-level carrier profitability and limited order visibility.

Backlogs stabilized modestly over the course of the year, but this improvement was driven almost entirely by production cuts rather than strengthening demand. The backlog-to-build (BL/BU) ratio remained historically low on a seasonally adjusted basis, signaling limited forward visibility and reinforcing OEM caution. As a result, 2026 orderboards remained light entering year-end, with production plans intentionally flexible.

This supply-side restraint has been a defining feature of the cycle, preventing a sharper inventory imbalance while accelerating the pace of fleet contraction.

Regulatory and Cost Pressures Reshape Buying Behavior

Regulatory uncertainty remained a central theme in 2025, though clarity improved late in the year. Industry communications suggest EPA intends to retain the core technology elements of the 2027 low-NOx rule while revising or removing extended warranty and useful-life provisions. ACT’s base case now assumes a partial rollback, reducing uncertainty but confirming that higher Class 8 prices in 2027 are unavoidable.

At the same time, §232 tariffs became fully embedded in OEM pricing during 2025, materially increasing acquisition costs—particularly for Mexico-sourced and mixed-content vehicles. These tariffs sit outside potential IEEPA rulings and represent a permanent upward shift in the cost curve.

Combined with elevated insurance premiums, higher financing costs, and rising compliance expenses, these pressures fundamentally reshaped fleet purchasing behavior. Capital allocation shifted decisively toward essential replacement, with discretionary and growth-oriented orders largely sidelined.

Capacity Rebalancing Gains Traction

The Class 8 market made tangible progress toward capacity normalization in 2025. Retail sales remained below replacement levels for much of the year, accelerating contraction in the active tractor population. Tractor inventories gradually corrected as OEMs held the line on production, while vocational inventories remained elevated and slower to normalize.

Used truck markets reflected this imbalance. Demand softened alongside freight volumes, and resale values declined across retail, auction, and wholesale channels. While this underscored lingering oversupply in secondary markets, it also reinforced the reality that excess capacity is being worked off—albeit unevenly.

ACT Research views this period as the early phase of a necessary reset, with capacity contraction expected to intensify further in 2026.

Orders: Weak, but Stabilizing

Class 8 orders remained weak through the peak ordering season, posting sharp year-over-year declines during months that historically generate the strongest activity. Carrier profitability remained deeply challenged, limiting willingness to commit capital beyond core replacement needs.

Importantly, cancellation rates stayed relatively contained, signaling that fleets largely adhered to existing plans rather than retrenching further. OEMs continued to prioritize margin protection and backlog alignment over volume growth, reinforcing a cautious and controlled supply environment.

Absent a clear inflection in freight demand or further policy relief, Class 8 demand finished 2025 hovering near replacement levels—a defining characteristic of the year.

Economic Context: Tailwinds Deferred, Risks Front-Loaded

Longer-term tailwinds—such as infrastructure spending, utility investment, and fleet aging—remain intact. However, near-term economic fragility dominated 2025. Freight-intensive sectors including housing, manufacturing, and energy remained soft, while trade-related disruptions and tariffs weighed heavily on carrier margins.

Publicly traded truckload carriers reported another year of recession-level profitability, reinforcing conservative fleet strategies. Smaller carriers faced heightened vulnerability amid tight credit conditions, rising costs, and limited pricing power, contributing to ongoing capacity attrition.

2025: The Bottoming Year for Class 8

The Class 8 truck market exits 2025 after a prolonged and unusually difficult downcycle marked by weak freight demand, elevated costs, tariff-driven uncertainty, and historically low profitability. Temporary distortions from pre-tariff activity provided fleeting relief but failed to change the underlying trajectory.

Crucially, 2025 marked the start of a meaningful structural reset. Sub-replacement sales, disciplined OEM production, and financial pressure across the carrier base have set capacity contraction firmly in motion. While that process lays the groundwork for recovery, it does not guarantee a rapid rebound.

Instead, 2026 is shaping up as a transition year—one defined by continued rebalancing, cautious fleet behavior, and gradual improvement rather than a full-cycle reset. The next upturn in the Class 8 market will be earned through capacity discipline and profitability recovery, not demand exuberance.

Jim Meil, Principal and Industry Analyst at ACT Research Co., shares his outlook on freight demand.

Want more data?

ACT’s commercial vehicle forecast delivers the most reliable, forward-looking insight into where Class 8 truck sales are headed—helping you anticipate shifts, plan with confidence, and stay ahead of the market.